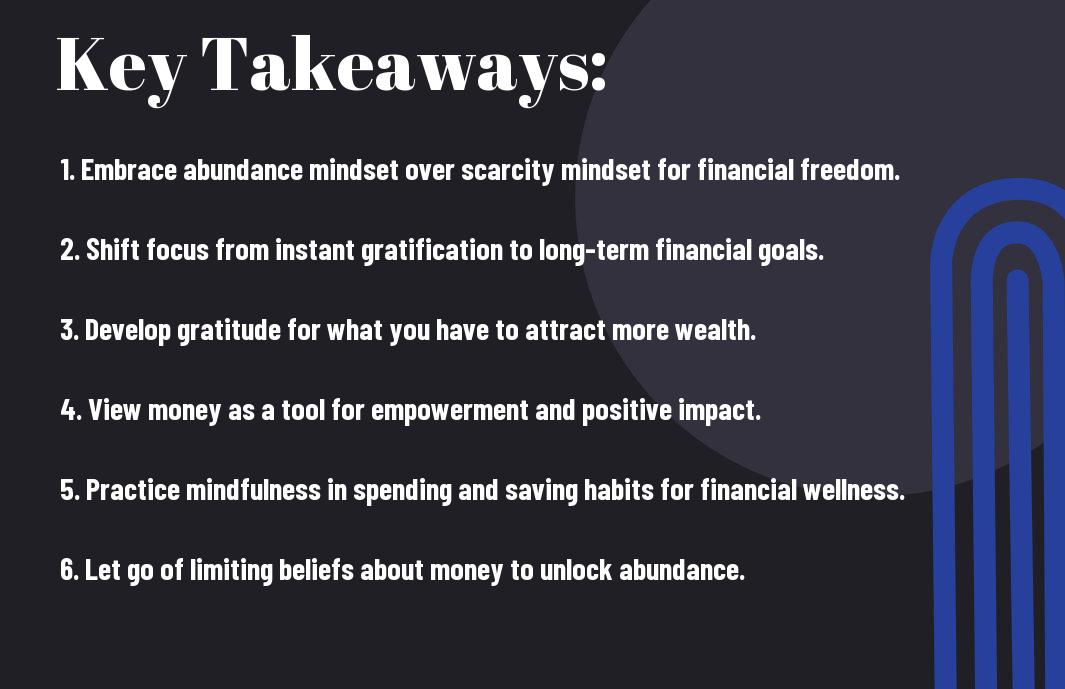

Mindset plays a crucial role in how we perceive and manage our finances. Oftentimes, the way we think about money can either empower us to achieve financial freedom or hold us back from reaching our financial goals. By making positive mindset shifts, individuals can transform their relationship with money and begin on a path to financial liberation.

In this blog post, we will probe into key mindset shifts that can help individuals break free from limiting beliefs about money and adopt healthier financial habits. From cultivating a mindset of abundance to embracing financial education and planning, these shifts can pave the way towards a more secure and fulfilling financial future. Let’s explore how changing your mindset can lead to financial liberation and empower you to take control of your financial well-being.

Understanding Your Current Financial Mindset

Before launching on your journey towards financial liberation, it is important to take a closer look at your current financial mindset. Your beliefs and attitudes towards money can greatly influence your financial decisions and ultimately shape your financial outcomes. By understanding your current financial mindset, you can identify any limiting beliefs that may be holding you back from achieving financial success.

Identifying Limiting Beliefs About Money

Any negative beliefs or attitudes you have about money can act as obstacles on your path to financial liberation. These beliefs may stem from childhood experiences, societal conditioning, or past financial struggles. Common limiting beliefs include thinking that money is scarce, believing that you are not capable of earning more, or feeling guilty about spending money on yourself. By recognizing and challenging these limiting beliefs, you can start to shift your mindset towards abundance and empowerment.

The Impact of Financial Habits on Your Life

Money plays a significant role in our daily lives, affecting our relationships, health, and overall well-being. Poor financial habits, such as overspending, neglecting savings, or living beyond your means, can lead to stress, anxiety, and financial insecurity. In fact, studies have shown that financial stress is a leading cause of anxiety and other mental health issues. By addressing and improving your financial habits, you can create a more stable and secure financial future for yourself.

The Power of Financial Education

The Money Mindset, Beliefs, and Habits are foundational elements that shape how individuals perceive and manage their relationship with money. By gaining a deeper understanding of these factors, individuals can start to shift their mindset towards financial liberation.

Foundations of Financial Literacy

On the journey towards financial liberation, establishing a strong foundation of financial literacy is crucial. This involves learning about basic concepts such as budgeting, saving, investing, and debt management.

Implementing Learning into Daily Financial Practices

Learning about financial concepts is only the first step. To truly transform your relationship with money, it is crucial to implement what you have learned into your daily financial practices. This can involve creating a budget, setting financial goals, tracking expenses, and making informed financial decisions based on your newfound knowledge.

Shifting from Scarcity to Abundance Mindset

Recognizing the Scarcity Mentality

Despite living in a world of abundant opportunities and resources, many individuals operate from a scarcity mentality when it comes to money. This mindset is rooted in fear, lack, and limitation, leading to behaviors such as hoarding, fear of spending, and constant worry about not having enough. Recognizing and acknowledging this scarcity mentality is the first step towards transforming your relationship with money.

Cultivating an Abundance Mindset for Financial Growth

On the other hand, cultivating an abundance mindset shifts your focus from what you lack to what you have and what is possible. It is about embracing a mindset of opportunity, gratitude, and abundance in all aspects of your financial life. By practicing affirmations, visualizing success, and surrounding yourself with positive influences, you can start reprogramming your mindset for financial growth and prosperity.

Abundance mindset opens up new possibilities for financial success, attracting more opportunities, and increasing your overall sense of fulfillment and satisfaction. By aligning your thoughts, beliefs, and actions with abundance, you can create a positive momentum that propels you towards achieving your financial goals.

Recognizing the shift from scarcity to abundance mindset is crucial for breaking free from limiting beliefs and behaviors that hold you back from financial liberation. As you embrace abundance in your thoughts and actions, you’ll begin to experience a profound shift in how you perceive and manage your relationship with money, ultimately leading you towards greater financial freedom and empowerment.

Embracing a Future-Oriented Financial Perspective

The Importance of Setting Financial Goals

Future-oriented financial perspective is crucial in the journey towards financial liberation. Setting clear, achievable financial goals is the first step in this transformative process. Research has shown that individuals who set specific financial goals are more likely to achieve them, compared to those who have vague aspirations. By defining clear objectives, you create a roadmap that guides your financial decisions, leading to greater accountability and success.

Strategies for Long-Term Financial Planning

Embracing a future-oriented financial perspective also involves adopting strategies for long-term financial planning. This may include creating a budget, saving for retirement, investing in assets, and managing expenses wisely. By implementing these proactive measures, individuals can secure their financial future and build wealth over time.

For instance, setting aside a portion of your income for emergency savings can provide a financial safety net in times of crisis. Additionally, investing in diversified portfolios can help grow your wealth and mitigate risks. By making deliberate choices today, you can pave the way for a financially secure tomorrow.

The Role of Budgeting in Financial Empowerment

Many individuals underestimate the power of budgeting in achieving financial liberation. Creating a budget that reflects your values is key to taking control of your finances. By outlining your income, expenses, and financial goals, you can align your spending with what truly matters to you. This shift in mindset from mindless spending to intentional budgeting can lead to a profound transformation in how you manage your money.

Creating a Budget that Reflects Your Values

To create a budget that reflects your values, start by defining what is important to you. Allocate a portion of your income towards areas that align with your values, such as saving for emergencies, investing in personal growth, or supporting causes you care about. By consciously directing your money towards what matters most, you can experience a sense of empowerment and control over your financial future.

The Discipline of Sticking to Your Financial Plan

The discipline of sticking to your financial plan is crucial in achieving long-term financial liberation. It requires consistent effort and commitment to avoid temptations and stay on track with your budgeting goals. This discipline involves making choices that may not always be easy but are necessary for your financial well-being. By cultivating the habit of staying true to your financial plan, you can build resilience against unexpected expenses and setbacks, ultimately leading to greater financial freedom.

This level of discipline may involve making sacrifices in the short term to achieve your long-term financial goals. It requires staying focused on the bigger picture and maintaining the willpower to resist impulse spending or deviating from your budget. By viewing discipline as a means to financial empowerment rather than restriction, you can shift your mindset towards seeing it as a tool for achieving true financial liberation.

Investing in Yourself for Financial Independence

Personal Development as a Financial Investment

Keep in mind that investing in yourself is one of the most powerful ways to achieve financial independence. Continuously working on personal development not only improves your skills and knowledge but also enhances your overall earning potential. By dedicating time and resources to self-improvement, you are directly investing in your future financial success.

Leveraging Skills and Knowledge for Economic Advancement

With the ever-evolving job market and advancements in technology, it is crucial to stay ahead by continually expanding your skills and knowledge. Leveraging your expertise in marketable areas can significantly boost your economic advancement and open up new opportunities for financial growth. By actively seeking ways to enhance your skill set and staying informed about industry trends, you are positioning yourself for long-term financial success.

Economic empowerment through skill development is important for achieving financial liberation. Individuals who invest in acquiring new skills and knowledge are better equipped to adapt to changing economic landscapes and secure their financial future. By harnessing the power of continuous learning and skill-building, individuals can enhance their earning potential and create more opportunities for financial growth and stability.

Building and Maintaining a Healthy Relationship with Money

Unlike common beliefs, financial liberation goes beyond just accumulating wealth or material possessions. It involves transforming the way individuals perceive and manage their relationship with money. To truly achieve financial liberation, one must adopt a mindset shift from scarcity to abundance. For more insights on this transformation, check out Transforming Your Money Mindset: Shifting from Scarcity to Abundance.

Mindful Spending and Intentional Consumption

The key to building a healthy relationship with money lies in mindful spending and intentional consumption. By being conscious of where your money is going and aligning your spending habits with your values and goals, you can cultivate a sense of empowerment and control over your financial decisions. This shift towards intentional consumption not only ensures that your money is being used purposefully but also helps in promoting a more sustainable and fulfilling lifestyle.

The Emotional Aspect of Money and How to Manage It

Relationships with money often carry emotional baggage that can impact financial decisions and behaviors. Understanding and managing the emotional aspect of money is crucial for achieving financial liberation. This involves recognizing your emotional triggers around money, addressing any negative beliefs or attitudes towards wealth, and practicing self-awareness when making financial choices. By developing a healthy emotional relationship with money, individuals can gain clarity, confidence, and peace of mind in their financial journey.

Final Words

Presently, shifting your mindset towards financial liberation can truly transform the way you perceive and manage your relationship with money. By reframing your beliefs and attitudes towards money, you can unlock a world of possibilities and freedom. As you adopt a growth mindset, prioritize financial education, and cultivate abundance thinking, you are setting yourself up for long-term success and prosperity. Bear in mind, financial liberation is not just about the numbers in your bank account; it is about cultivating a healthy, empowering relationship with money that aligns with your values and goals.

So, take the time to reflect on your current mindset around money and start taking small, actionable steps towards financial liberation. Seek out resources, tools, and support systems that can help you along the way. Embrace the journey of self-discovery and empowerment as you reshape your financial narrative and pave the way for a brighter, more abundant future. With the right mindset shifts in place, you have the power to achieve true financial liberation and live a life of abundance and fulfillment.

FAQ: Mindset Shifts for Financial Liberation – Transforming Your Relationship with Money

Q: What is the significance of mindset shifts in achieving financial liberation?

A: Mindset shifts play a crucial role in financial liberation as they help individuals break limiting beliefs, embrace abundance, and adopt positive habits towards money management.

Q: How can changing one’s perception of money lead to financial liberation?

A: By viewing money as a tool for growth and freedom rather than a source of stress or lack, individuals can shift their mindset towards abundance and attract prosperity into their lives.

Q: What are some common limiting beliefs about money that hinder financial liberation?

A: Common limiting beliefs include “money is the root of all evil,” “I will never be wealthy,” or “I don’t deserve to be financially secure.” These beliefs create barriers to financial success and must be addressed through mindset shifts.

Q: How can individuals start transforming their relationship with money?

A: To transform their relationship with money, individuals can start by educating themselves about personal finance, setting clear financial goals, practicing gratitude for what they already have, and seeking support from financial mentors or experts.

Q: What are some practical tips for maintaining a positive money mindset?

A: Practical tips include regularly reviewing and adjusting your budget, practicing mindful spending, visualizing financial success, surrounding yourself with positive influences, and cultivating a mindset of abundance and prosperity.