Finances and wealth are often viewed through the lens of numbers, budgets, and investments. However, one crucial element that is often overlooked in the quest for financial success is gratitude. Cultivating a mindset of gratitude can have a significant impact on your financial well-being, leading to a more abundant and fulfilling life. In this blog post, we will explore the powerful connection between gratitude and wealth, and how practicing thankfulness can positively influence your financial situation.

The Science of Gratitude

Psychological Effects of Gratitude

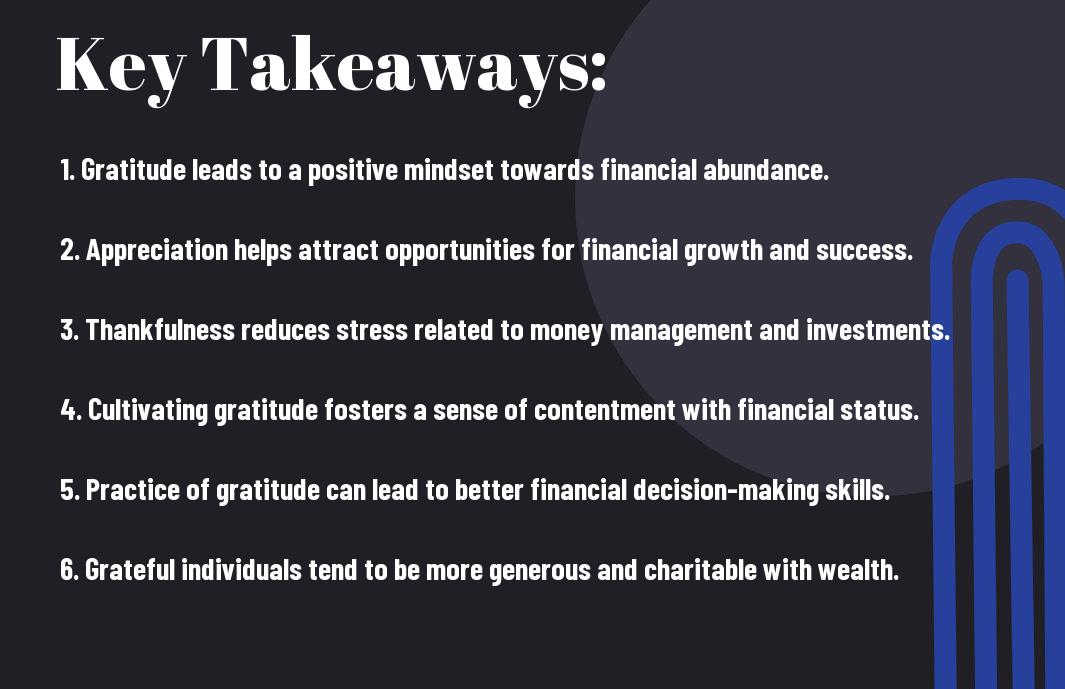

While many people view gratitude as simply a polite response, research actually shows that cultivating gratitude can have a significant impact on our mental well-being. Studies have found that regularly expressing gratitude can increase happiness levels, reduce symptoms of depression and anxiety, and improve overall psychological health. By focusing on what you have rather than what you lack, you can shift your mindset to a more positive and abundant perspective.

Gratitude in Behavioral Economics

For individuals working on their financial well-being, integrating principles of gratitude into their decision-making process can lead to more positive outcomes. Behavioral economics, a field that combines psychology and economics, explores how emotions and cognitive biases influence our financial choices. By practicing gratitude, individuals may be more likely to make thoughtful and rational financial decisions, leading to better money management and long-term wealth accumulation.

Behavioral economics studies have also shown that individuals who are grateful for their current financial situation are more likely to engage in future-oriented thinking and set meaningful financial goals. By appreciating what they already have, individuals may be inspired to take proactive steps towards building a more secure financial future.

Gratitude and Spending Habits

Even as we navigate the world of finances, our spending habits play a crucial role in shaping our financial well-being. How we approach spending, whether impulsively or mindfully, can significantly impact our overall wealth.

Impulse Spending Versus Mindful Spending

Impulse spending, fueled by emotions or external influences, often leads to unnecessary purchases and financial strain. In contrast, mindful spending involves thoughtful consideration of needs versus wants, prioritizing long-term financial goals over instant gratification. By practicing gratitude and being mindful of our spending habits, we can avoid impulse purchases and make informed decisions that align with our financial objectives.

The Role of Gratitude in Consumer Decisions

With a mindset of gratitude, individuals tend to approach consumer decisions more consciously. Research shows that grateful individuals are less materialistic and more satisfied with what they have, leading to reduced impulse buying and increased financial security. By acknowledging and appreciating what they already possess, individuals are less likely to engage in unnecessary spending and more inclined to make thoughtful financial choices that contribute to their overall well-being.

Gratitude and Income Generation

Once again, we probe into the powerful connection between gratitude and financial well-being, focusing this time on how a thankful mindset can impact income generation. Gratitude is not only beneficial for personal well-being but can also play a significant role in shaping one’s financial success.

Career Advancement Through a Grateful Mindset

With a grateful mindset, individuals are more likely to excel in their careers and increase their income potential. Expressing gratitude can improve workplace relationships, leading to better collaboration and teamwork. Additionally, grateful employees are often more motivated, resilient, and productive, qualities that are highly valued by employers.

Gratitude and Networking

Through networking, one can unlock various opportunities for career growth and income generation. Gratitude plays a crucial role in networking success as people are more inclined to help those who show appreciation. By expressing gratitude towards professional contacts and cultivating meaningful relationships, individuals can expand their network and open doors to new possibilities.

This interconnectedness between gratitude and income generation highlights the importance of fostering a thankful mindset in all aspects of life, including career advancement and networking efforts.

Gratitude and Saving Behavior

How Thankfulness Influences Saving Decisions

For many individuals, practicing gratitude can lead to more mindful saving habits. When people are grateful for what they have, they are less likely to engage in impulsive spending and more inclined to prioritize long-term financial goals. Studies have shown that individuals who regularly express gratitude are more likely to save money consistently and make wiser financial decisions.

Gratitude as a Buffer Against Financial Stress

One way in which gratitude can positively impact financial well-being is by acting as a buffer against financial stress. Those who regularly practice gratitude tend to have a more positive outlook on their financial situation, even in times of hardship. Research has revealed that individuals who maintain a grateful attitude towards their finances experience lower levels of anxiety and depression related to money issues. This emotional resilience can lead to better financial decision-making and overall wealth accumulation.

Buffering against the negative effects of financial stress, gratitude provides individuals with the mental fortitude to navigate challenging financial circumstances without succumbing to detrimental behaviors, such as overspending or excessive worry. By fostering a sense of appreciation for their current financial state and the resources available to them, individuals can approach money matters with a clear and rational mindset, ultimately leading to increased financial stability and security.

Gratitude and Investment Strategies

Your investment strategies are crucial in shaping your financial future. Cultivating gratitude can play a significant role in guiding your investment decisions. Research has shown that gratitude not only improves overall well-being but also positively impacts financial health. To probe deeper into how gratitude directly influences financial well-being, check out How Gratitude Improves Your Life — And Your Finances for insightful information.

Patient Capital and Long-Term Thinking

With gratitude as a guiding principle, investors can embrace patient capital and develop a long-term investment perspective. By appreciating the value of long-term financial goals, individuals are more likely to make sound investment choices that contribute to wealth accumulation over time. Gratitude fosters a mindset of delayed gratification, discouraging impulsive decisions and encouraging strategic investment strategies that prioritize sustainable growth.

Gratitude’s Impact on Risk Tolerance and Diversification

LongTerm Planning your financial future, gratitude can enhance your risk tolerance and promote diversification within your investment portfolio. Maintaining a thankful outlook allows investors to navigate market volatility with resilience and composure, leading to more informed risk management practices. Additionally, gratitude encourages diversification by promoting a balanced approach to asset allocation, which can mitigate potential losses and optimize investment returns over the long run.

Impact of incorporating gratitude into your investment approach extends beyond mere financial gains. By infusing gratitude into your investment strategies, you are not only enhancing your financial well-being but also fostering a mindset of abundance and mindful wealth management.

Cultivating Gratitude to Enhance Financial Health

Not only does expressing gratitude have a positive impact on our overall well-being, but it also plays a crucial role in shaping our financial health. According to a study conducted by Singer Wealth Management, individuals who practice gratitude regularly tend to have better financial habits and are more likely to achieve long-term financial success. To research deeper into this connection, check out Why Gratitude is Essential for You and Your Finances.

Daily Practices to Foster Gratitude

Foster a sense of gratitude in your daily life by incorporating simple practices that can lead to a more positive outlook on your finances. Start your day by journaling about things you are grateful for, whether it’s the roof over your head, the food on your table, or the support of loved ones. Take time to reflect on your financial accomplishments, no matter how small, and acknowledge the progress you have made towards your financial goals.

Behavioral Changes for Sustainable Wealth Management

With a mindset of gratitude, you can make behavioral changes that promote sustainable wealth management. For instance, practicing mindful spending by being grateful for the resources you have can help you avoid unnecessary purchases and stay on track with your budget. Additionally, expressing gratitude towards your financial successes and learning from setbacks can lead to a more disciplined approach to money management.

Gratitude in Financial Planning and Goal Setting

Setting and Achieving Financial Goals with Gratitude

Unlike traditional financial planning that solely relies on numbers and strategies, integrating gratitude into your financial goals can provide a powerful boost to your wealth-building journey. With a grateful mindset, individuals are more likely to set clear and meaningful financial goals that are aligned with their values and priorities. Gratitude enhances motivation and determination, helping individuals stay focused on their objectives and navigate challenges with resilience.

By practicing gratitude in goal setting, individuals can visualize and manifest their desired financial outcomes with more clarity and positivity. This proactive approach can lead to increased productivity, smarter decision-making, and a heightened sense of financial well-being. Cultivating gratitude in financial goals creates a sense of abundance and fulfillment, fueling the momentum needed to turn dreams into reality.

Incorporating Gratitude into Personal and Family Finance

Goals are imperative in financial planning, but the journey towards achieving them is equally significant. By incorporating gratitude into personal and family finance practices, individuals can foster a healthy relationship with money and wealth. Expressing gratitude for what you have and acknowledging the resources available can cultivate a sense of contentment and reduce the tendency for impulsive or unnecessary spending.

Planning with gratitude also encourages mindful financial habits, such as budgeting, saving, and investing wisely. When individuals approach financial decisions with thankfulness and appreciation, they are more likely to make choices that prioritize long-term financial well-being over short-term gratification. Integrating gratitude into personal and family finance fosters a positive financial mindset that can lead to sustainable wealth accumulation and overall financial stability.

Challenges and Considerations

Finding Balance Between Gratitude and Ambition

After understanding the positive impact gratitude can have on financial well-being, it is crucial to find a balance between gratitude and ambition. While it is necessary to be grateful for what you have, it is also important to maintain a level of ambition and drive to achieve your financial goals. Finding this balance can be challenging, as too much gratitude may lead to complacency, while too much ambition can foster a sense of never being satisfied.

Addressing the Skepticism: When Gratitude Seems Hard to Find

When faced with financial challenges or setbacks, it can be difficult to cultivate a sense of gratitude. However, it is during these times that practicing gratitude becomes even more crucial. By focusing on what you do have rather than what you lack, you can shift your mindset towards one of abundance and positivity. It may seem daunting at first, but even small acts of gratitude, such as keeping a gratitude journal or expressing thanks to others, can make a significant difference in your overall financial well-being.

Plus, studies have shown that individuals who regularly practice gratitude tend to have lower levels of stress and higher levels of overall happiness, both of which can positively impact financial decision-making and wealth accumulation. By addressing skepticism and actively cultivating gratitude, you can pave the way for a more fulfilling and financially secure future.

Conclusion

Presently, it is clear that there is a strong connection between gratitude and financial well-being. By cultivating a sense of gratitude, individuals are able to shift their focus away from scarcity and lack, and instead, appreciate all that they have. This mindset can positively impact wealth by fostering a sense of abundance and attracting more opportunities for financial growth.

Furthermore, practicing gratitude can also improve one’s overall well-being, leading to better decision-making, increased motivation, and a greater sense of fulfillment. By embracing gratitude as a daily practice, individuals can create a positive cycle of abundance and wealth in their lives, ultimately leading to a more prosperous and fulfilling financial future.

FAQ

Q: How does gratitude impact financial well-being?

A: Gratitude has been shown to positively impact financial well-being by promoting a mindset of abundance and contentment, which can lead to more responsible financial behavior and better decision-making when it comes to budgeting, saving, and investing.

Q: Can cultivating gratitude lead to increased wealth?

A: Yes, cultivating gratitude can lead to increased wealth by shifting focus away from feelings of lack or scarcity towards appreciation for what one already has. This shift in mindset can promote a more positive relationship with money and opportunities for growth and prosperity.

Q: How can one incorporate gratitude into their financial practices?

A: One can incorporate gratitude into their financial practices by keeping a gratitude journal to regularly reflect on and appreciate their financial blessings, practicing mindfulness when it comes to spending and saving money, and expressing gratitude towards others who have supported their financial journey.