It’s no secret that our relationship with money is deeply intertwined with our mindset and beliefs. Budgeting, at its core, is not just about numbers and spreadsheets; it’s about understanding your psychological tendencies and how they influence your financial habits and decision-making. By delving into the psychological aspects of budgeting, we can gain insight into why we make certain financial choices and how we can harness our mindset to achieve our money goals.

Money Mindsets and Their Origins

The Role of Upbringing in Financial Behavior

An individual’s upbringing plays a significant role in shaping their money mindset and financial habits. The way one was raised in relation to money, whether it be frugal or lavish, can greatly impact their spending and saving behaviors. For example, growing up in a household where money was tight may lead to a more cautious and budget-conscious approach to finances, while being raised in a family where money was readily available could result in a more carefree attitude towards spending.

Cultural and Societal Influences on Spending

Cultural and societal influences also play a crucial role in shaping one’s financial behavior. Different cultures have varying attitudes towards money, savings, and spending, which can influence an individual’s financial decisions. For instance, in some cultures, saving for the future is prioritized and seen as a sign of financial responsibility, while in others, conspicuous consumption and living in the present moment are valued.

Psychological Barriers to Effective Budgeting

The Instant Gratification Trap

Any individual can fall victim to the allure of instant gratification, which can be a significant barrier to effective budgeting. It is the tendency to prioritize immediate pleasures over long-term financial goals. This mindset can lead to impulsive spending, making it challenging to stick to a budget and save for the future.

The Phenomenon of Money Illusion

The phenomenon of money illusion refers to individuals’ tendency to focus on nominal values rather than real purchasing power. This can lead to misjudgments in financial decision-making, such as underestimating inflation’s impact on their savings. The perception of wealth can be skewed by not considering the true value of money in different contexts.

Plus, understanding and recognizing the phenomenon of money illusion can help individuals make more informed financial decisions and adjust their budgeting strategies accordingly. By acknowledging the discrepancy between nominal and real values, individuals can prioritize their spending and savings more effectively.

Cognitive Biases That Affect Spending

Budgeting is influenced by various cognitive biases that can impact spending habits and financial decision-making. For example, individuals may fall prey to confirmation bias, seeking out information that supports their spending choices while ignoring contradictory evidence. This can lead to overspending and difficulties in sticking to a budget.

Money, being a significant aspect of our daily lives, is subject to various psychological influences that can affect how we approach budgeting and financial decision-making. Being aware of these psychological barriers and biases can help individuals develop strategies to overcome them and build healthier financial habits.

The Emotional Aspects of Money

The Connection Between Money and Self-Worth

To truly understand the psychological aspects of budgeting, we must first recognize the deep-rooted connection between money and self-worth. An individual’s financial situation often serves as a reflection of their perceived value and worth in society. Studies have shown that individuals who derive their self-esteem from material possessions or financial success are more likely to experience stress and anxiety related to money management.

The Impact of Money on Relationships

Money plays a crucial role in shaping our relationships, both positively and negatively. Finances can create tension and conflict within partnerships, as differing money mindsets and habits often lead to disagreements. Research has found that financial disagreements are one of the leading causes of divorce, highlighting the significant impact money can have on relationships.

Coping with Financial Anxiety and Stress

Managing financial anxiety and stress is important for maintaining overall well-being. Many individuals experience feelings of overwhelm and insecurity when faced with financial challenges. Seeking support from a financial advisor or therapist can help individuals develop healthy coping mechanisms and strategies to navigate through difficult financial situations.

Goal Setting and Motivation

Now, when it comes to budgeting, one of the crucial aspects is setting realistic financial goals. In order to achieve success with your budget, it is important to establish clear and attainable objectives. Setting specific goals provides you with a roadmap to follow and helps you stay focused on your financial priorities. Whether your goal is to save for a down payment on a house, pay off debt, or build an emergency fund, having a concrete target in mind will help guide your budgeting decisions.

Setting Realistic Financial Goals

For many individuals, setting realistic financial goals can be a challenging task. However, it is necessary to define achievable objectives that align with your financial situation and lifestyle. According to a study by the American Psychological Association, individuals who set specific goals are more likely to reach them compared to those who have vague or unattainable goals. By breaking down your larger financial goals into smaller, manageable targets, you can track your progress and celebrate your achievements along the way.

Finding Your ‘Why’: The Drive Behind Your Budget

Any successful budgeting effort is often fueled by a strong sense of motivation and purpose. Understanding the underlying reasons behind your financial decisions can greatly impact your ability to stick to a budget. By identifying your ‘why’ – whether it’s securing financial stability, providing for your family, or achieving long-term financial freedom – you can cultivate a deep sense of motivation that will drive your commitment to your budgeting goals. Research has shown that individuals who have a clear sense of purpose are more likely to exhibit disciplined financial behaviors and make smarter financial choices.

This sense of purpose not only helps you stay focused on your financial goals but also serves as a constant reminder of the importance of budgeting in achieving your long-term financial success. By uncovering your ‘why’ and understanding the deeper motivations behind your financial decisions, you can create a more sustainable and effective budgeting mindset that drives positive financial habits and decision-making.

Strategies for Behavioral Change in Budgeting

Your Understanding Your Money Mindset (Paperback) plays a crucial role in shaping your financial habits and decision-making. By recognizing the psychological aspects of budgeting, you can implement effective strategies for behavioral change.

The Power of Habit Formation

With the understanding that habits play a significant role in our financial behaviors, it is necessary to focus on habit formation when working towards improving budgeting practices. Research shows that it takes an average of 66 days for a new behavior to become automatic, highlighting the importance of consistency and repetition in establishing positive budgeting habits.

Reward Systems and Positive Reinforcement

For many individuals, incorporating reward systems and positive reinforcement can be instrumental in incentivizing budget adherence. By setting achievable financial goals and rewarding oneself for meeting milestones, individuals can create a positive association with budgeting behaviors. Rewards can range from small treats to larger incentives, providing motivation and reinforcement for continued financial discipline.

Powering through challenges and setbacks can be challenging without adequate motivation. Utilizing rewards as a form of positive reinforcement can significantly impact adherence to budgeting plans, ultimately leading to long-term financial success.

Using Technology to Enhance Budgeting Habits

With the advancements in technology, there are various tools and apps available to help individuals enhance their budgeting habits. From budget tracking applications to automated savings programs, technology can streamline financial management processes and provide valuable insights into spending patterns. By utilizing these resources, individuals can gain a better understanding of their financial behaviors and make informed decisions to improve their budgeting practices.

Another beneficial aspect of incorporating technology into budgeting is the convenience and accessibility it offers. With real-time updates and personalized features, individuals can actively monitor their financial progress and stay accountable to their budgeting goals.

Overcoming Setbacks and Maintaining Discipline

Unlike overspending, setbacks in budgeting are a common occurrence that almost everyone faces at some point. These setbacks can be discouraging and may lead to feelings of frustration or even defeat. However, it is necessary to remember that setbacks are a natural part of the budgeting process and should be viewed as opportunities for growth and learning. To learn more about the psychological aspects of spending, check out The Psychology of Spending: Understanding Your Money Mindset.

Strategies for Dealing with Financial Roadblocks

Financial roadblocks can come in many forms, such as unexpected expenses, job loss, or even poor financial decisions. To navigate these challenges, it is crucial to have a plan in place. One strategy is to build an emergency fund that can cover three to six months’ worth of expenses. This can provide a safety net during times of uncertainty and help prevent further financial setbacks. Additionally, seeking advice from a financial advisor or counselor can offer guidance and support in creating a plan to overcome financial obstacles.

Remaining Resilient in the Face of Temptation

An important aspect of maintaining discipline in budgeting is remaining resilient in the face of temptation. It can be challenging to stick to a budget when faced with the allure of impulse purchases or peer pressure to overspend. One way to combat these temptations is by setting clear financial goals and reminding yourself of the bigger picture. By focusing on your long-term financial well-being, you can stay motivated and disciplined in your budgeting efforts.

This intentional mindset shift can help you stay on track and make informed financial decisions that align with your goals and values.

Advanced Budgeting Techniques and Mindfulness

Keep the following advanced techniques in mind when developing a mindful budget:

- Tracking Expenses: One key aspect of budgeting is understanding where your money is going. By tracking your expenses, you can identify patterns and make informed decisions about where to cut back.

- Setting Realistic Goals: Establishing specific financial goals can help you stay motivated and focused on your budgeting efforts. Make sure your goals are realistic and achievable to avoid becoming discouraged.

- Mindful Spending Practices:

Spending Mindful Observation Allocate a specific amount for discretionary spending Practice mindfulness when making purchase decisions - Long-term Planning and the Psychology of Future Thinking:

Any Long-Term Planning Develop a savings plan for future goals Understand the psychological benefits of delayed gratification

Mindful Spending Practices

Spending mindfully involves being aware of your financial decisions and their impact on your budget. By setting a specific amount for discretionary spending and practicing mindfulness when making purchase decisions, you can align your spending habits with your financial goals.

Long-term Planning and the Psychology of Future Thinking

In the context of long-term planning, it’s necessary to develop a savings plan for future goals and understand the psychological benefits of delayed gratification. By thinking about the future and prioritizing long-term financial stability over short-term impulses, you can make strategic decisions that support your overall financial well-being.

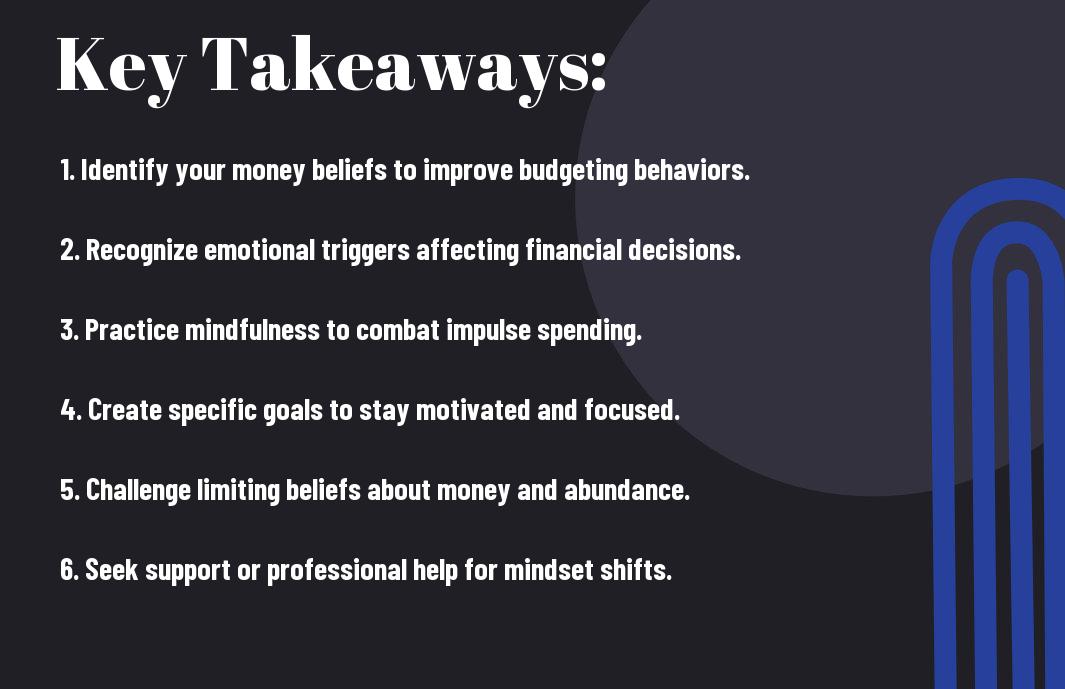

To wrap up

As a reminder, understanding the psychological aspects of budgeting is necessary for improving your financial habits and decision-making. Your mindset plays a crucial role in how you approach money management, influencing your beliefs, behaviors, and ultimately, your financial well-being. By exploring and examining your money mindset, you can identify any negative patterns or biases that may be hindering your ability to budget effectively. Through self-reflection and possible interventions, such as financial therapy or coaching, you can develop a healthier relationship with money and take control of your finances.

Recall, budgeting is not just about numbers and spreadsheets; it’s also about exploring your beliefs, emotions, and attitudes towards money. By shifting your mindset and adopting positive financial habits, you can create a more balanced and sustainable approach to budgeting, leading to greater financial stability and peace of mind. So, take the time to understand your money mindset, challenge any negative beliefs, and make conscious choices that align with your financial goals and values. Your future financial success depends on it.

Frequently Asked Questions

Q: Why is understanding the psychological aspects of budgeting important?

A: Understanding the psychological aspects of budgeting is crucial because it helps individuals recognize how their mindset influences their financial habits and decision-making. By gaining insight into one’s money mindset, individuals can make positive changes to their spending and saving behaviors.

Q: What role does mindset play in financial habits?

A: Mindset plays a significant role in shaping financial habits. Our attitudes, beliefs, and emotions towards money influence how we perceive budgeting, saving, and spending. A positive money mindset can lead to healthy financial habits, while a negative mindset may result in poor money management.

Q: How can I identify my money mindset?

A: To identify your money mindset, reflect on your thoughts and feelings about money. Consider your attitudes towards saving, spending, and budgeting. Pay attention to any limiting beliefs or behaviors that may be impacting your financial decisions. Seeking the help of a financial therapist or counselor can also aid in uncovering your money mindset.

Q: How can I change my money mindset for the better?

A: Changing your money mindset for the better requires self-awareness, willingness to change, and consistent effort. Start by challenging any negative beliefs or behaviors around money. Set clear financial goals and create a budget that aligns with your values and priorities. Surround yourself with positive influences and seek support from financial professionals or mentors.

Q: What are the benefits of having a healthy money mindset?

A: Having a healthy money mindset can lead to improved financial well-being, reduced stress, and increased confidence in managing your finances. It can also help you make better financial decisions, set and achieve your goals, and foster a positive relationship with money. By cultivating a healthy money mindset, you can take control of your financial future and build a secure financial foundation.