In today’s volatile economy, it’s imperative to be prepared for potential financial downturns that can impact individuals and families. From unexpected job loss to market crashes, there are various factors that can lead to a decrease in income or financial stability. To navigate through these challenging times, it’s crucial to have a plan in place to safeguard your finances and ensure you can weather any storm that comes your way.

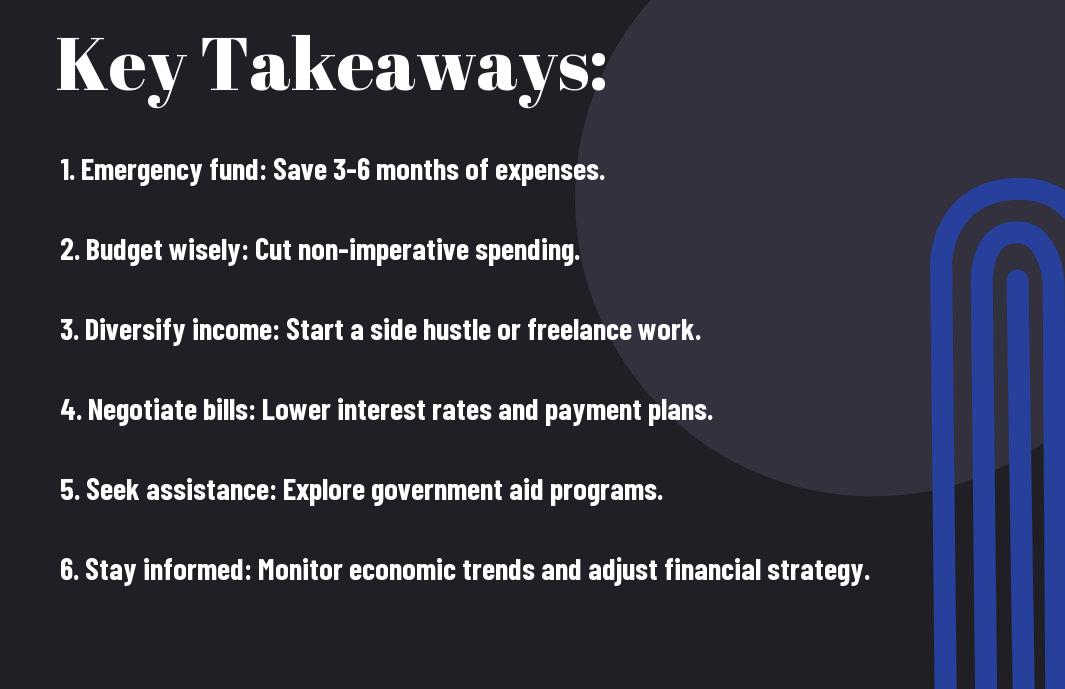

Key Takeaways:

- Emergency Fund: Having an emergency fund with at least 3-6 months’ worth of expenses is crucial during a financial downturn to cover unexpected costs and ensure financial stability.

- Reduce and Prioritize Spending: Evaluate your expenses and cut back on non-necessary items to conserve cash. Prioritize necessary expenses such as housing, utilities, and food.

- Diversify Income Sources: Explore opportunities to supplement your income through freelancing, part-time work, or investments to reduce dependence on a single income source.

- Review and Adjust Investments: Stay informed about market trends and consider reallocating your investments to lower-risk options during a financial downturn to minimize potential losses.

- Seek Professional Advice: Consult with a financial advisor or counselor to create a comprehensive financial plan tailored to your situation and develop strategies to navigate through challenging financial times.

Understanding the Signs of a Financial Downturn

One important aspect of safeguarding your finances is being able to recognize the signs of a financial downturn before it escalates. According to a recent article in the Washington Post on Seven ways you can financially prepare for a recession, there are key indicators to watch for and proactive steps you can take to protect yourself financially.

Economic Indicators to Watch

The first step in preparing for a financial downturn is to keep a close eye on economic indicators. The health of the stock market, unemployment rates, consumer spending trends, and GDP growth are crucial factors that can signal an impending recession. By staying informed about these indicators and understanding their implications, you can make informed decisions to protect your finances.

Analyzing Personal Financial Exposure

To effectively safeguard your finances during a downturn, it’s crucial to assess your own financial exposure. Take inventory of your assets, liabilities, and sources of income. Evaluate your level of debt, the stability of your job or business, and the resilience of your investment portfolio. By analyzing your personal financial situation, you can identify areas of vulnerability and take proactive steps to mitigate risks.

Another important aspect of analyzing your personal financial exposure is assessing your emergency savings. Aim to have at least three to six months’ worth of living expenses saved in an accessible account to weather any financial storm that may come your way.

Building a Financial Safety Net

You need to be prepared for unexpected financial challenges by building a solid safety net. One of the key steps to safeguarding your finances is by creating an emergency fund. This fund should ideally cover at least three to six months’ worth of living expenses. To learn more about how to save money and prepare for a recession, check out Our Best Money Tips For A Recession.

Emergency Fund Essentials

Safety doesn’t happen by chance. It’s crucial to prioritize building an emergency fund as a solid financial cushion to protect yourself during tough times. Having this reserve can provide peace of mind and financial security when facing unexpected job loss, medical emergencies, or other crises.

Diversification and Risk Management

Management is key when it comes to protecting your finances. Diversification plays a vital role in minimizing risk and ensuring that your investments are not overly concentrated in one asset or sector. By spreading your investments across different asset classes such as stocks, bonds, real estate, and savings accounts, you can reduce the impact of volatility in any single market.

Diversification is a proven strategy to manage risk and potentially enhance returns, especially during financial downturns. It’s necessary to regularly review and adjust your investment portfolio to align with your financial goals and risk tolerance.

Budgeting During Tough Times

Your financial well-being during a downturn greatly depends on how well you manage your budget. By carefully monitoring your income and expenses, you can navigate through challenging times with greater ease.

Conducting a Financial Audit

Any financial audit should begin with a thorough assessment of your current financial situation. Take stock of your income sources, expenses, debts, and savings. This will help you understand where your money is going and where you can make adjustments to improve your financial stability.

Prioritizing Expenses and Cutting Costs

Financial downturns often require a recalibration of your expenses. It’s crucial to prioritize crucial expenses such as housing, utilities, and groceries while cutting back on non-crucial spending. Data shows that during a financial crisis, households tend to reduce their discretionary spending by an average of 20-30%.

Managing Debt Wisely

Keep your debts in check by staying proactive and vigilant during a financial downturn. It’s crucial to have a plan in place to navigate through tough times. For more tips on preparing for a personal financial crisis, check out 10 Ways to Prepare for a Personal Financial Crisis.

Negotiating with Creditors

The first step in managing debt during financial hardship is to communicate with your creditors. Be honest about your situation and explore options for temporary relief, such as forbearance or payment plans. By negotiating with creditors, you may be able to secure lower interest rates or reduced monthly payments to make your debts more manageable.

Strategies for Consolidating and Paying Off Debt

Managing debt wisely also involves developing strategies for consolidating and paying off debts effectively. Consider consolidating high-interest debts into a single, lower-interest loan to simplify repayment and potentially save money on interest charges. By creating a realistic budget and prioritizing debt repayment, you can work towards becoming debt-free and building a more secure financial future.

Increasing Income and Preserving Wealth

Identifying Alternative Income Streams

Not all sources of income are created equal, especially during times of financial instability. Diversifying your income streams is crucial to protect yourself from unexpected downturns. Consider taking on a side job, freelancing, or starting a small business to supplement your primary income. These alternative income options can provide a safety net and potentially increase your overall financial security.

Protecting Your Investments from Volatility

An crucial aspect of safeguarding your wealth is protecting your investments from market turbulence. Any wise investor knows the importance of diversification and keeping a close eye on the performance of their assets. Consider shifting your investments towards more stable options, such as bonds or real estate, to minimize the impact of market volatility. Additionally, regularly reviewing and adjusting your investment portfolio based on market conditions can help mitigate potential losses.

Income diversification is one of the most effective strategies for weathering financial downturns. Instead of relying solely on a single source of income, having multiple streams can offer stability and flexibility in uncertain times. By proactively seeking out alternative income opportunities and protecting your investments, you can better secure your financial future and navigate through any economic challenges that may come your way.

Government Assistance and Community Resources

Understanding and Accessing Government Aid

Assistance from the government can be a vital resource during financial downturns. Programs like unemployment benefits, food assistance, and housing aid are available to help individuals weather economic challenges. It’s important to understand the eligibility criteria and application process for these programs to access the support you need.

During the COVID-19 pandemic, for example, the CARES Act provided expanded unemployment benefits and stimulus payments to millions of Americans. Stay informed about government assistance programs through official websites and local agencies to take advantage of available resources.

Leveraging Community Support Systems

Government aid is not the only source of support during tough times. Community resources such as food banks, rental assistance programs, and non-profit organizations can also provide valuable assistance. These organizations often offer services tailored to specific needs, such as childcare support or job training programs, to help individuals navigate financial challenges.

To access community support systems, reach out to local social service agencies, religious organizations, or community centers in your area. Networking with neighbors and friends can also lead you to valuable resources and support networks. By leveraging both government assistance and community resources, individuals can create a robust financial safety net during times of economic turmoil.

Long-term Financial Planning

Reevaluating Financial Goals

After experiencing a financial downturn, it is crucial to reevaluate your financial goals to ensure they are still realistic and aligned with your current situation. Take the time to reassess your short-term and long-term objectives, adjusting them as needed to reflect any changes in your income, expenses, or overall financial stability. By setting clear, achievable goals, you can better focus your efforts on rebuilding your financial health and securing a more stable future.

Planning for Future Economic Shifts

Financial downturns are a sobering reminder of the importance of planning for future economic shifts. To safeguard your finances against potential downturns, consider diversifying your income sources, building an emergency fund, and investing in assets that offer stability and long-term growth potential. By taking proactive steps now, you can better position yourself to weather future economic uncertainties and protect your financial well-being.

Shifts in the economy can happen unexpectedly, impacting individuals and businesses alike. By staying informed about market trends and economic indicators, you can make informed decisions about your finances and adjust your strategies accordingly. Being proactive and adaptable in your financial planning can help mitigate the impact of economic shifts and ensure your long-term financial security.

Mental and Emotional Well-being

Coping with Financial Stress

With financial downturns becoming more common in today’s volatile economy, it’s crucial to have strategies in place to cope with the stress that may accompany such situations. The uncertainty of financial stability can take a toll on one’s mental and emotional well-being, leading to anxiety, depression, and other negative emotions.

Staying Positive and Proactive

Wellbeing during a financial downturn involves more than just managing your finances; it also includes taking care of your mental health. Staying positive and proactive is key to navigating through tough times. By maintaining a hopeful outlook and focusing on what you can control, you can better handle the challenges that come your way.

Another important aspect of staying positive and proactive is seeking support from loved ones, financial advisors, or mental health professionals. Don’t hesitate to reach out for help when needed, as talking to someone about your concerns can provide valuable insights and guidance.

Final Words

With these considerations in mind, individuals can navigate financial downturns with greater resilience and preparedness. By taking proactive steps to assess their financial situation, reduce expenses, increase savings, and explore alternative sources of income, individuals can safeguard their finances and weather economic challenges more effectively. It is important to remember that financial downturns are a normal part of the economic cycle, and being prepared can make a significant difference in one’s ability to bounce back and thrive in the long run. By staying informed, staying vigilant, and taking practical steps to protect your finances, you can better position yourself to withstand the challenges that come with economic uncertainty.