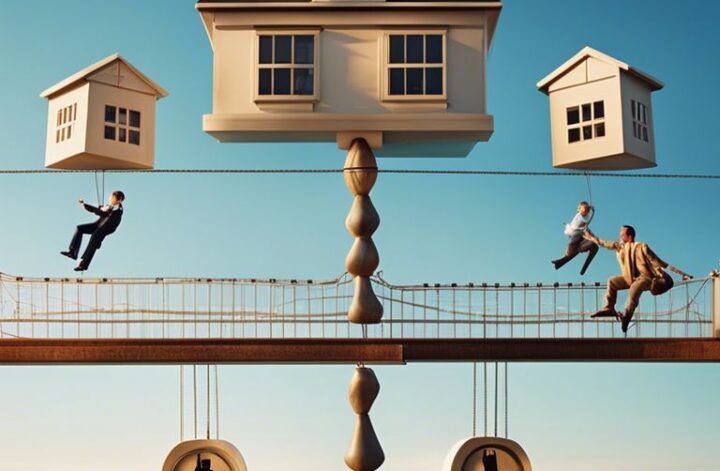

With the demands of work and family constantly pulling working parents in multiple directions, finding a balance between financial goals and family responsibilities can be a challenging task. The pressure to provide for the family while also being present for important milestones and events can often feel overwhelming. However, with some strategic planning and practical tips, it is possible to navigate this delicate balance successfully.

Setting Financial Goals as a Working Parent

To ensure a secure financial future for your family, it is crucial to establish clear financial goals as a working parent. Short-term, mid-term, and long-term financial planning are all necessary aspects of this process.

Short-term, Mid-term, and Long-term Financial Planning

Any working parent should start by outlining short-term financial goals such as saving for emergencies, healthcare expenses, or home repairs. These goals provide a sense of security and stability in the present moment. Mid-term goals could include saving for your child’s education or a family vacation, while long-term financial planning might involve retirement savings, investments, or buying a house.

Creating a Family Budget That Works

Short-term financial goals can often be achieved by creating a realistic family budget that takes into account your income, expenses, and savings targets. It is necessary to track your spending habits, identify areas where you can cut back, and allocate funds towards your financial goals. By setting a budget and sticking to it, you can ensure that your family’s financial needs are met while still working towards your long-term goals.

Time Management Strategies for Working Parents

It is no secret that working parents often feel a constant juggling act, trying to balance family responsibilities while also meeting financial goals. Time management is key to finding a harmonious balance between work, family, and personal commitments.

Prioritizing Family Time and Work Commitments

Strategies to prioritize family time and work commitments involve setting clear boundaries and learning to say no when necessary. By establishing a routine and sticking to a schedule, working parents can ensure they dedicate quality time to their children while also excelling in their professional endeavors.

Efficiency Tips for Managing Household Tasks

Working parents can optimize their time by delegating household tasks to family members or utilizing time-saving tools such as meal delivery services or cleaning apps. By creating a household chore schedule and tackling tasks in a systematic manner, parents can free up more time to spend with their loved ones.

- Delegate tasks to family members based on their abilities and availability.

- Utilize meal prep services or plan menus in advance to save time on cooking and grocery shopping.

After implementing efficiency tips for managing household tasks, working parents can experience a significant reduction in stress levels and have more time to focus on what truly matters – their family relationships.

Managing Work and Family Balance

It is crucial for working parents to establish boundaries between work and family time. Creating a designated workspace at home can help separate professional responsibilities from family time, allowing for better focus and productivity during work hours. Additionally, setting aside dedicated family time without any work distractions is crucial for maintaining a healthy work-life balance.

- Set specific work hours and stick to them to avoid burnout and maintain a healthy work-life balance.

- Communicate openly with employers about your family commitments to seek flexibility when needed.

Achieving a Work-Life Balance

Not being able to find a balance between work and family life can be a real struggle for many working parents. The constant juggling act of managing career responsibilities while also attending to family needs can often leave individuals feeling overwhelmed and stressed. However, it is possible to strike a healthy equilibrium between these two areas of life, enabling individuals to excel in their careers while also prioritizing their family’s well-being. For more insights on balancing work and family life, check out What are some ways to balance work and family life as a parent on Quora.

The Role of Flexibility in the Workplace

On the journey to achieving a successful work-life balance, the role of workplace flexibility cannot be underestimated. Companies that offer flexible work arrangements, such as telecommuting options, flexible hours, or compressed workweeks, empower working parents to better navigate the demands of their professional and personal lives. By providing these flexible work options, employers not only support their employees’ well-being but also promote higher productivity and job satisfaction.

Strategies for Negotiating Work Flexibility

One effective strategy for negotiating work flexibility is to highlight the mutual benefits that flexible arrangements can bring to both employees and employers. By showcasing how flexible work options lead to increased productivity, improved job satisfaction, and reduced turnover, working parents can make a compelling case for why these arrangements are valuable for all parties involved. Plus, demonstrating a willingness to be creative and find alternative solutions, such as job sharing or staggered hours, can further showcase a commitment to finding workable solutions that benefit both the individual and the organization.

Financial Planning for Your Children’s Future

Despite the daily demands of balancing work and family life, it is imperative for working parents to also prioritize financial planning for their children’s future. One of the key aspects of this planning involves setting aside funds for their education, ensuring they have access to quality learning opportunities without incurring significant debts.

Education Savings Accounts and Their Benefits

Financially preparing for your children’s education can be made easier through the use of education savings accounts, such as 529 plans or Coverdell Education Savings Accounts. These accounts offer tax-advantaged ways to save and invest for educational expenses, allowing parents to grow their savings over time while minimizing tax liabilities.

Exploring Life Insurance and Estate Planning for Parents

Any responsible parent should consider exploring life insurance and estate planning options to safeguard their family’s financial future in case of unexpected events. Life insurance policies provide a financial safety net for children and spouses in the event of a parent’s untimely death, ensuring they are provided for and can maintain their standard of living. Estate planning, including wills and trusts, can help allocate assets and ensure your children inherit according to your wishes, minimizing potential conflicts and uncertainties.

Parents can consult with financial advisors or estate planning professionals to create a comprehensive plan that addresses their unique circumstances and goals, providing peace of mind and security for their loved ones. By taking proactive steps to secure their children’s future through effective financial planning, working parents can navigate the challenges of balancing family responsibilities and financial goals with confidence.

Building a Financial Safety Net

Emergency Funds: How Much and How to Start

With statistics showing that approximately 40% of Americans cannot cover a $400 emergency expense, having an emergency fund is crucial for working parents. To determine how much you need in your emergency fund, consider aiming for at least three to six months’ worth of living expenses. To start, set a realistic savings goal and automate transfers to this fund from each paycheck. By gradually building up your emergency savings, you can have peace of mind knowing you have a financial cushion for unexpected expenses.

Understanding and Selecting Family Health Insurance

The importance of having appropriate health insurance for your family cannot be overstated. With rising healthcare costs, adequate coverage can protect you from financial strain in the event of illness or injury. When deciding on a health insurance plan, consider factors such as premiums, deductibles, and network coverage. The right plan should strike a balance between cost and coverage, ensuring your family’s healthcare needs are met without breaking the bank.

To make an informed decision, take the time to understand the terms and conditions of different health insurance options. Compare plans based on your family’s specific healthcare needs and budget constraints. Remember that health insurance is an investment in your family’s well-being and financial security, so choose wisely.

Smart Investing for Working Parents

Basics of Investing for Beginners

To effectively balance family responsibilities with financial goals, it’s crucial for working parents to understand the basics of investing. Investing allows you to grow your money over time, creating a more secure financial future for yourself and your family. To start, consider setting up a diversified investment portfolio that includes a mix of stocks, bonds, and other assets. This can help spread out risk and increase the potential for long-term growth.

Retirement Planning: Pensions, 401(k)s, and IRAs

To ensure a comfortable retirement while juggling family obligations, it’s crucial for working parents to prioritize retirement planning. Pensions, 401(k)s, and Individual Retirement Accounts (IRAs) are valuable tools that can help you build a nest egg for your golden years. By contributing regularly to these retirement accounts and taking advantage of any employer matches, you can maximize your savings potential and secure a financially stable future for you and your loved ones.

In addition, understanding the specifics of each retirement account, such as contribution limits, tax advantages, and withdrawal rules, can help you make informed decisions about your retirement planning strategy.

Cultivating Healthy Family Dynamics Around Finances

Many working parents struggle to balance their family responsibilities with their financial goals. It’s imperative to foster open communication and healthy money management habits within the family unit. For tips on balancing work and family, check out How To Balance Work and Family: 5 Tips for Busy Parents.

Teaching Children About Money Management

Any parent knows that teaching children about money management is crucial for their future financial success. Start by setting a good example with responsible spending and saving habits. Encourage your children to save a portion of their allowance or earnings and involve them in discussions about family budgets and financial goals. By instilling these fundamental money management skills early on, you are setting them up for a lifetime of financial independence and success.

Communicating About Finances with Your Partner

Money plays a significant role in relationships, and open communication about finances is imperative for a healthy partnership. Regularly check in with your partner about financial goals, expenses, and concerns. Set aside designated times to discuss your finances and make joint decisions about budgeting, saving, and investing. By working together as a team towards shared financial objectives, you can strengthen your partnership and alleviate financial stress.

Money management is a key aspect of family dynamics, and by fostering a culture of financial transparency and communication within your family, you can ensure financial stability and harmony. Encourage discussions about money, set mutual financial goals, and support each other in making financial decisions that benefit the entire family. By cultivating healthy family dynamics around finances, you can create a strong foundation for your family’s financial well-being now and in the future.

Leveraging Resources and Support Systems

Community and Online Resources for Working Parents

Support from community and online resources can be invaluable for working parents juggling family responsibilities and financial goals. Local support groups, online forums, and social media communities can provide a platform for sharing experiences, seeking advice, and connecting with like-minded individuals facing similar challenges. Additionally, resources such as childcare services, parenting classes, and financial planning workshops can offer practical guidance and support.

When and How to Seek Professional Financial Advice

Resources such as financial advisors, accountants, and credit counselors can provide expert guidance on managing finances, setting financial goals, and creating a comprehensive financial plan. It’s important for working parents to seek professional financial advice when facing complex financial decisions, such as investing for their children’s education or planning for retirement. Professional advice can help ensure that financial goals align with family priorities and long-term aspirations.

Navigating Financial Hardships and Setbacks

Dealing with Job Loss or Reduced Income

Unlike more predictable changes, such as unexpected expenses, job loss or a sudden decrease in income can significantly disrupt a family’s financial stability. With the unpredictability of the job market and economic downturns, it’s crucial for working parents to have a plan in place to navigate through such challenges.

Managing Debt and Credit Responsibly

Financial challenges can often lead to the accumulation of debt, making it more difficult for working parents to achieve their financial goals. It is crucial to prioritize managing debt and credit responsibly to avoid further financial strain. By creating a budget, prioritizing payments, and seeking professional guidance if needed, parents can take control of their debt and work towards financial stability.

This includes monitoring credit scores regularly to ensure that the debt-to-credit ratio stays low and to identify any potential issues early on.

To wrap up

From above real-life scenarios, it is evident that juggling family responsibilities and financial goals can be a challenging task for working parents. However, with proper planning and prioritization, it is possible to achieve a balance between the two. Practical tips such as setting a budget, establishing savings goals, seeking out affordable childcare options, and communicating openly with your partner can help working parents navigate the complexities of managing both their family and financial obligations.

Note, it is vital to find a harmonious equilibrium between work, family, and finances to lead a fulfilling and sustainable lifestyle. By implementing these practical tips and remaining flexible and adaptable in your approach, working parents can successfully navigate the challenges of balancing family responsibilities and financial goals.

FAQ

Q: How can working parents balance family responsibilities and financial goals effectively?

A: Working parents can balance family responsibilities and financial goals by creating a budget that includes both short-term expenses and long-term savings goals. It is important to prioritize needs over wants and involve the entire family in financial decisions. Setting realistic goals and regularly reviewing finances can help maintain balance.

Q: What are some practical tips for saving money as a working parent?

A: Practical tips for saving money as a working parent include meal planning to reduce food expenses, shopping for imperatives in bulk, utilizing coupons and discounts, and cutting back on unnecessary expenses like dining out or subscription services. Establishing an emergency fund can also provide financial security in times of need.

How can working parents manage their time effectively to balance work, family, and financial responsibilities?

A: To manage time effectively, working parents can utilize tools like calendars and planners to schedule family activities, work commitments, and financial tasks. Setting boundaries and delegating responsibilities within the family can help distribute the workload. It is imperative to prioritize self-care and personal time to prevent burnout and maintain a healthy work-life balance.