Budgeting for travel can often seem like an overwhelming task, especially for young professionals eager to satisfy their wanderlust without breaking the bank. However, with the right strategies in place, it is entirely possible to plan and save for exciting adventures without compromising on experiences. In this blog post, we will explore practical and effective […]

Bridging the Gap – Budgeting for Student Loans and Debt Repayment

You may have recently graduated and are now faced with the reality of paying off your student loans. While the thought of managing debt repayment alongside your other expenses may seem daunting, developing a budget and a repayment plan can help you navigate this financial challenge effectively. In this guide, we will provide you with […]

Starting a Family on a Budget – Real Stories of Financial Planning

Just the thought of starting a family can be both exciting and overwhelming. One of the biggest concerns that many couples face when launching on this journey is how to manage their finances while raising children. With the rising costs of childcare, education, and healthcare, financial planning becomes crucial for new parents. In this blog […]

The 50/30/20 Rule – Simplifying Your Budgeting Approach

Many individuals struggle with managing their finances effectively, often feeling overwhelmed by the complexities of budgeting. Enter the 50/30/20 rule – a straightforward and practical approach to allocating your income for needs, wants, and savings. This rule provides a clear framework for organizing your finances and ensuring that you are prioritizing imperative expenses, discretionary spending, […]

Budgeting for Beginners – A Simple Guide to Financial Freedom

Just starting out on your journey towards financial freedom? Budgeting is the key foundation to achieving your financial goals and taking control of your money. In this beginner-friendly guide, we will cover the basics of budgeting, providing you with practical tips and strategies to help you manage your finances effectively. By following these simple steps, […]

Savings for Special Occasions – Budgeting for Celebrations

Over the years, special occasions and celebrations have become synonymous with spending money extravagantly. From birthdays and holidays to weddings and anniversaries, these events hold significant importance in our lives and often come with a hefty price tag. However, with proper planning and smart financial habits, it is possible to save specifically for these moments […]

Financial Literacy Month Special – Intensive Budgeting Bootcamp

Financial Literacy Month is a time to focus on empowering individuals with the knowledge and skills needed to take control of their finances. To celebrate this important initiative, we are excited to announce our month-long series on intensive budgeting education. Our “Intensive Budgeting Bootcamp” is designed to provide participants with the tools and strategies they […]

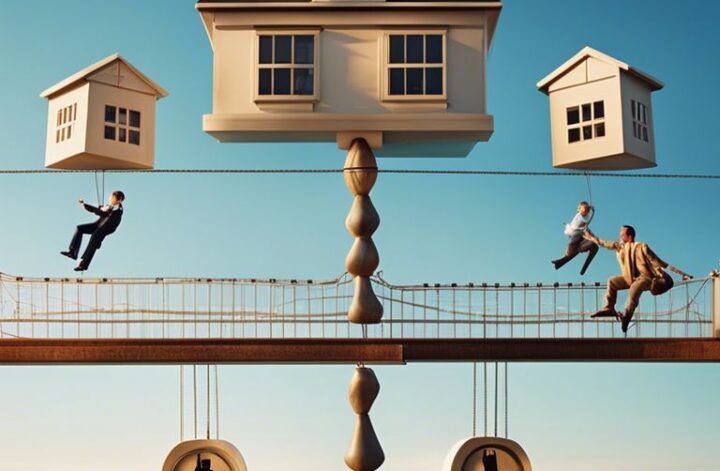

Balancing Act – Budgeting for Multiple Financial Goals

It’s no secret that managing your finances can feel like a juggling act at times. With various short-term and long-term goals competing for your limited resources, finding the right balance can be a challenge. Whether you’re saving for a down payment on a house, paying off student loans, building an emergency fund, or investing for […]

Traveling on a Budget – Real Stories of Affordable Adventures

Most people assume that traveling on a budget means compromising on experiences or missing out on the fun. However, the stories of individuals who have successfully begined on budget-friendly adventures prove otherwise. These real-life travelers have shown that with careful planning, smart decisions, and a bit of creativity, it is possible to explore the world […]

Savings Buckets – A Creative Approach to Budgeting

With careful planning and strategic allocation of funds, creating savings “buckets” can be a highly effective method to reach your financial goals and manage expenses. This approach involves compartmentalizing your savings into specific categories or goals, allowing you to easily track your progress and stay motivated to stick to your budget. By assigning each bucket […]