You’ve heard the saying “good things come to those who wait,” and when it comes to saving money, practicing delayed gratification can be a powerful strategy. Delayed gratification is the ability to resist the temptation of immediate reward in order to achieve a larger, more significant reward in the long run. This concept can have a profound impact on your ability to save money and build wealth over time.

By choosing to delay gratification and forgo immediate purchases or indulgences, you can redirect those funds towards long-term savings goals such as retirement, a home purchase, or financial independence. This disciplined approach to spending not only helps you accumulate more savings over time but also fosters good financial habits that can lead to long-lasting financial security. In this blog post, we will explore the benefits of delayed gratification and how it can significantly boost your long-term savings.

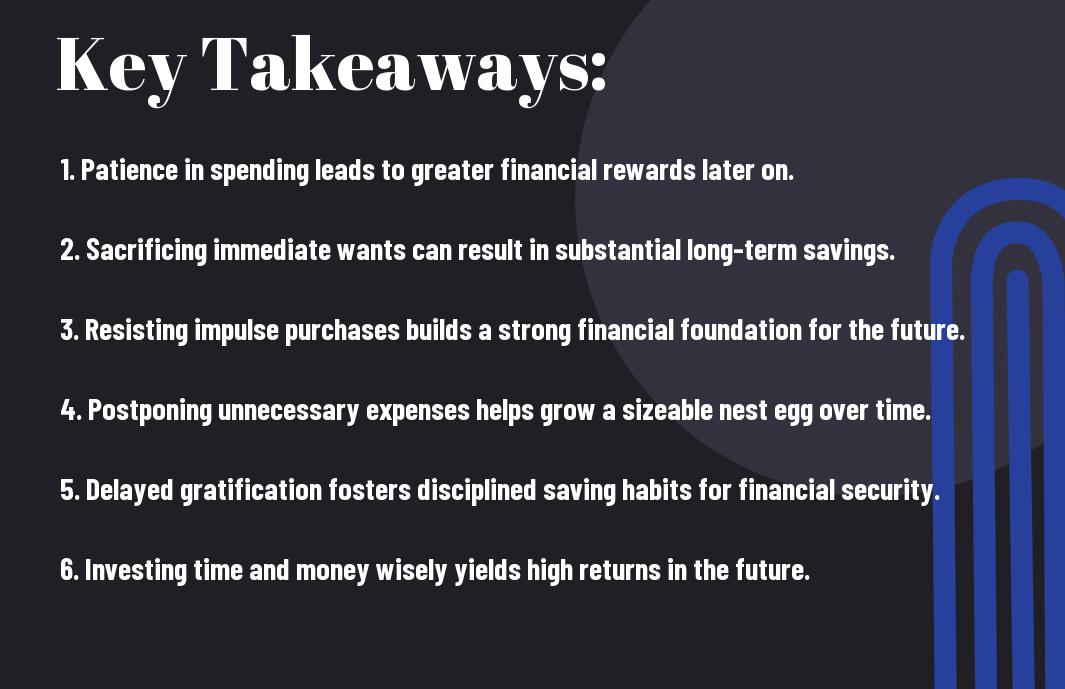

Key Takeaways:

- Delayed gratification is the ability to resist the temptation of immediate rewards in order to obtain a larger or more valuable reward in the future.

- Practicing delayed gratification can significantly boost long-term savings as it involves prioritizing future financial goals over immediate wants and desires.

- By delaying instant gratification and consistently saving money, individuals can accumulate a substantial amount of savings over time through the power of compounding and investment growth.

- Developing the habit of delayed gratification can lead to increased financial discipline, better financial decision-making, and ultimately, a more secure financial future.

- Setting specific financial goals and reminding oneself of the benefits of delayed gratification can help individuals stay motivated and committed to building long-term savings.

The Psychology Behind Delayed Gratification

Even in our fast-paced society, the concept of delayed gratification holds immense value when it comes to boosting long-term savings. As discussed in Should Savings Really Be Delayed Gratification? – ColeFP, understanding the psychology behind delayed gratification is crucial for achieving financial stability.

Defining Self-Control and Its Role

Defining self-control as the ability to regulate one’s actions, thoughts, and emotions in alignment with long-term goals is crucial in the context of delayed gratification. It plays a vital role in resisting immediate temptations and choosing to prioritize future financial security over instant gratification. By cultivating self-control, individuals can make informed decisions that benefit their long-term savings goals.

The Impact of Cultural and Environmental Factors

Cultural and environmental factors significantly influence an individual’s ability to practice delayed gratification and save for the future. For instance, societies that prioritize consumerism and instant gratification over saving and investment may hinder individuals from developing the necessary discipline to delay immediate rewards for greater financial benefits in the future. Assume that individuals exposed to environments that promote saving and financial literacy are more likely to embrace delayed gratification as a strategy for long-term wealth accumulation.

Psychology

Delayed gratification has been extensively studied in psychology, with landmark studies like the Stanford marshmallow experiment demonstrating the benefits of delaying rewards. By understanding the psychological principles behind delayed gratification, individuals can leverage this concept to boost their long-term savings and financial well-being.

The Marshmallow Experiment and Its Lessons

Now, if you want to learn more about how delayed gratification can significantly impact your long-term savings, I highly recommend checking out The Power of Delayed Gratification in Your Financial Journey. This insightful article probes into the concept and its practical applications in building wealth.

Overview of the Experiment

Marshmallow

Long-Term Findings and Implications for Savings

Marshmallow

Experience is the best teacher, and the Marshmallow Experiment demonstrates how the ability to delay gratification can have a profound impact on our financial well-being. By being patient and disciplined in our spending habits, we can cultivate a mindset that prioritizes long-term financial security over short-term desires. This not only helps in building savings but also fosters a sense of financial responsibility and resilience in the face of economic uncertainties.

Strategies for Enhancing Delayed Gratification

Goal Setting for Long-Term Savings

Keep your eyes on the prize by setting clear and achievable long-term financial goals. By outlining specific milestones and targets, you create a roadmap for your savings journey. Research shows that individuals who set goals are more likely to accumulate wealth over time compared to those who do not have a clear financial plan.

Establishing Rewards for Milestones

On your path to long-term savings success, it’s crucial to establish rewards for reaching key milestones. Treat yourself for each achievement along the way, whether it’s reaching a certain savings target, consistently contributing a set amount each month, or sticking to your budget. By incorporating rewards into your savings strategy, you reinforce positive financial behaviors and stay motivated to continue delaying immediate gratification.

Rewards serve as incentives that help you stay on track and maintain momentum towards your long-term savings goals. They can be anything from treating yourself to a small indulgence to setting aside a portion of your savings for a special purchase or experience. By celebrating your progress and acknowledging your hard work, you reinforce the importance of delayed gratification and build a positive association with saving for the future.

Financial Planning and Delayed Gratification

Budgeting with Long-Term Objectives

Objectives Not only is delayed gratification a key component of financial planning, it also plays a crucial role in boosting long-term savings. By prioritizing future financial goals over immediate desires, individuals can create a budget that aligns with their long-term objectives. This strategic approach allows for better resource allocation and helps in building a solid foundation for saving and investing.

The Role of Financial Literacy

Gratification Delayed gratification is closely linked to financial literacy, which involves understanding the concepts of saving, investing, and budgeting. A financially literate individual is more likely to make informed decisions about their money, including the choice to delay immediate rewards in favor of achieving long-term financial security. Studies have shown that individuals with higher levels of financial literacy tend to have higher savings rates and better overall financial well-being.

Planning As individuals enhance their financial literacy and incorporate delayed gratification into their financial planning, they are better equipped to make sound financial decisions that benefit their long-term savings goals. By setting realistic objectives, creating a structured budget, and staying committed to delayed gratification, individuals can significantly boost their long-term savings and achieve financial stability.

The Role of Technology in Supporting Delayed Gratification

Apps and Tools for Tracking Savings

Role-playing technology can play a vital role in supporting delayed gratification and boosting long-term savings. There are various apps and tools available that can help individuals track their saving progress, set savings goals, and stay motivated to stick to their financial plans. According to recent studies, individuals who track their savings progress regularly are more likely to meet their long-term financial goals. These tools provide visual representations of progress and allow users to see how small changes can lead to significant savings over time, reinforcing the importance of delayed gratification.

Automating Savings to Reduce Temptation

An automated approach to savings can further support the concept of delayed gratification by removing the temptation to spend impulsively. By setting up automated transfers from a checking account to a savings account on a regular basis, individuals can prioritize savings without having to actively make the decision every time. This method can help individuals overcome the psychological barriers to saving and increase the likelihood of sticking to a long-term savings plan. With the rise of fintech solutions, automating savings has become easier than ever, empowering individuals to prioritize their financial health and practice delayed gratification.

Overcoming Challenges to Delayed Gratification

Once again, the concept of delayed gratification proves to be crucial in achieving long-term success in various aspects of life. As highlighted by the importance of delayed gratification, it is imperative to recognize and resist instant gratification temptations in order to stay committed to your long-term savings goals.

Recognizing and Resisting Instant Gratification Temptations

The key to successful delayed gratification lies in developing the ability to identify and overcome the temptations of immediate rewards. The incessant urge to indulge in impulsive purchases or instant gratification can derail your savings plan and hinder your progress towards achieving financial stability. By acknowledging these temptations and actively resisting them, you can reinforce your commitment to long-term savings and stay focused on your ultimate financial objectives.

Coping Mechanisms and Support Systems

Systems of support and effective coping mechanisms play a significant role in bolstering your resolve to practice delayed gratification. Surrounding yourself with like-minded individuals who share your commitment to long-term savings can provide invaluable encouragement and motivation. Additionally, implementing practical coping strategies, such as setting short-term goals, creating visual reminders of your financial aspirations, and seeking professional guidance when needed, can further enhance your ability to resist instant gratification temptations and stay on track towards achieving your savings goals.

Conclusion

As a reminder, delayed gratification is a powerful concept that can significantly boost long-term savings. By resisting the temptation to spend money on immediate wants and instead focusing on long-term financial goals, individuals can build wealth and secure their financial future. Practice delayed gratification by creating a budget, setting savings goals, and prioritizing needs over wants. By consistently practicing delayed gratification, individuals can develop healthy financial habits and enjoy the rewards of financial security and independence in the future.

Ultimately, the ability to delay gratification and make smart financial decisions is a key component of building wealth and achieving financial success. By practicing delayed gratification and making intentional choices with money, individuals can secure a comfortable financial future and enjoy the benefits of long-term savings. Start today by implementing strategies to practice delayed gratification, and watch as your savings grow over time, leading to greater financial stability and peace of mind.