Many people dream of owning their own home, but the process of buying your first house can be both exciting and overwhelming. From finding the right property to navigating the complex world of real estate transactions, there are numerous challenges, decisions, and financial considerations to take into account. In this blog post, we will examine into the real-life scenario of buying a first home, offering valuable insights and tips to help you successfully navigate the real estate market and make the best choices for your future.

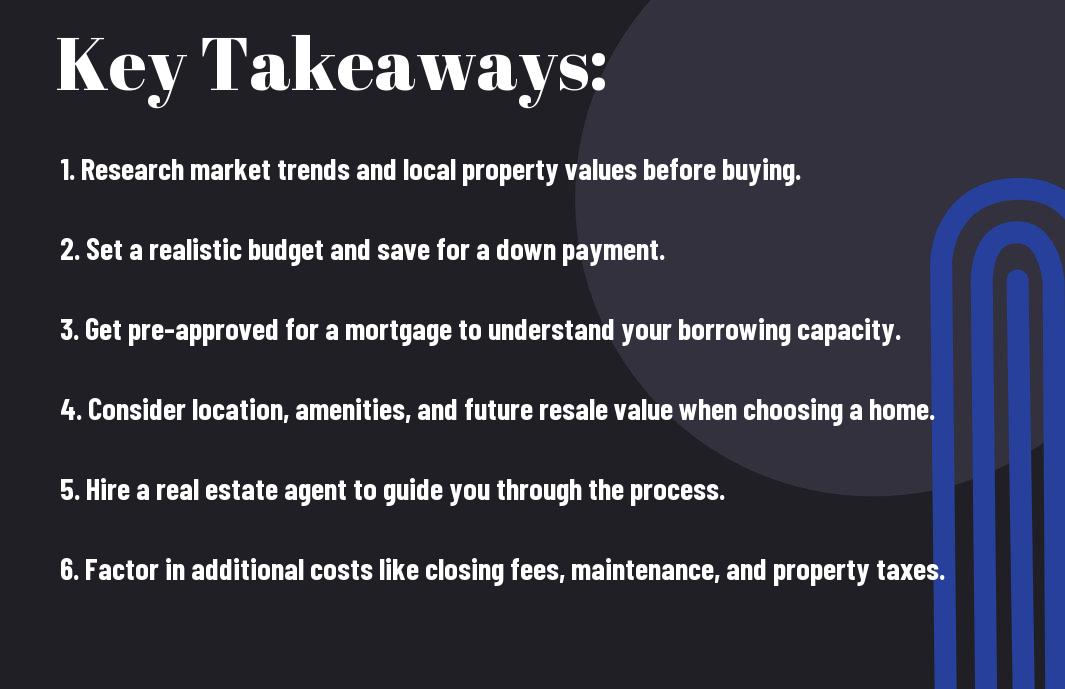

Key Takeaways:

- Financial Preparation: Saving for a down payment, understanding mortgage options, and considering additional costs like closing fees are crucial steps in the home-buying process.

- Market Research: Researching neighborhoods, comparing prices, and staying realistic about your budget are crucial for finding the right home.

- Decision-Making: Balancing your wants and needs, negotiating offers, and considering resale value are key factors in making informed decisions while purchasing your first home.

- Home Inspection: Conducting a thorough home inspection is vital to uncover any potential issues, ensuring you are making a sound investment in the long run.

- Professional Guidance: Working with a real estate agent, mortgage lender, and other professionals can provide valuable expertise and guidance throughout the home-buying process.

Assessing Financial Readiness

The Navigating the Real Estate Market: Tips for First-Time Homebuyers can be a daunting task, especially when it comes to assessing your financial readiness. Analyzing your budget and saving for a down payment are important steps to take before stepping into the real estate market.

Analyzing Your Budget and Saving for a Down Payment

Before begining on the journey of buying your first home, it’s crucial to understand your current financial situation. Take a close look at your income, expenses, and existing debts to determine how much you can afford to spend on a home. Additionally, start saving for a down payment, which typically ranges from 3% to 20% of the home’s purchase price. Setting a realistic budget and diligently saving for a down payment will set a solid foundation for your home buying process.

Understanding Credit Scores and Mortgage Pre-approval

With the average home price in the current market standing at $380,000, understanding credit scores and obtaining a mortgage pre-approval are vital steps in the home buying process. Your credit score plays a significant role in determining the interest rate you’ll receive on your mortgage loan. A higher credit score can potentially save you thousands of dollars over the life of your loan. Getting pre-approved for a mortgage will give you a clear understanding of how much you can borrow, helping you narrow down your home search to properties within your budget. Your financial readiness rests on solid credit and a pre-approval that sets the stage for a successful home purchase.

The Role of Real Estate Agents

Even in today’s digital age, real estate agents play a pivotal role in the home buying process. Their expertise, negotiation skills, and knowledge of the local market can make all the difference in finding your dream home. Choosing the right agent is crucial to ensuring a smooth and successful home buying experience.

Choosing the Right Agent for Your Home Buying Adventure

Estate agents act as your trusted advisor, guiding you through the complexities of the real estate market. They help you navigate listings, schedule showings, and negotiate offers on your behalf. When selecting an agent, consider their experience, reputation, and communication style. A good agent will listen to your needs, offer valuable insights, and work tirelessly to find the perfect home for you.

How Agents Facilitate the Home Buying Process

The role of a real estate agent goes beyond just finding properties. Agents facilitate the entire home buying process, from identifying potential homes to closing the deal. They handle paperwork, coordinate inspections, and ensure a seamless transaction. The agent’s knowledge of market trends and pricing strategies can also help you make informed decisions when making an offer on a property.

This makes it vital to choose an experienced agent who understands your budget and preferences. With their expertise, agents can help you navigate the complexities of the real estate market with confidence and ease.

Navigating Home Types and Neighborhoods

Many first-time homebuyers are faced with the decision of choosing between different types of homes and neighborhoods when entering the real estate market. It’s crucial to consider the pros and cons of each option before making a decision. To help you navigate this process, check out the following tips compiled from expert sources and real estate professionals:

| Deciding Between New Construction | For many first-time homebuyers, the idea of a brand-new home with modern amenities and customization options is appealing. However, new construction homes typically come with a higher price tag and may require patience as they are built. |

| Resale | Resale homes offer the advantage of established neighborhoods, mature landscaping, and potential for renovation. These homes may be more budget-friendly compared to new construction, but they may require updates and repairs. |

| Fixer-Uppers | Fixer-upper homes can be a great investment for those willing to put in the time and effort to renovate and increase the property’s value. However, they come with the risk of unexpected costs and may require extensive work. |

Evaluating Neighborhoods: Safety, Schools, and Amenities

Between deciding on the type of home, it’s vital to consider the neighborhood where it’s located. Safety is a top priority for most homebuyers, so researching crime rates and local security measures is crucial. Additionally, access to quality schools is vital for families or future resale value. Evaluating the proximity to amenities such as parks, restaurants, and shopping centers can also impact your daily life and overall satisfaction with the location.

Another factor to consider is the potential for future appreciation in value. Investing in a home in a well-maintained and desirable neighborhood can lead to substantial growth in equity over time. Take the time to research the area’s historical property values and trends to make an informed decision that aligns with your long-term goals.

Making the Offer and Negotiating

The Art of Crafting a Competitive Offer

Unlike browsing listings online or attending open houses, making an offer on a home is a crucial step that requires careful consideration. Crafting a competitive offer involves more than just determining the right price; it also involves understanding the current market conditions, the seller’s motivations, and the overall value of the property. To stand out in a competitive market, your offer should be well-prepared, encompassing not just the price but also other terms and conditions that may appeal to the seller.

Techniques for Negotiating in a Seller’s vs. Buyer’s Market

Crafting effective negotiation strategies is important when buying your first home. In a seller’s market, where demand outweighs supply, buyers may face intense competition and higher prices. Techniques such as offering a quick closing time or including a personalized letter to the seller can help set your offer apart. In contrast, in a buyer’s market, where there are more properties available than buyers, you may have more leverage to negotiate for a lower price or request repairs or concessions before finalizing the deal.

Sellers tend to have the upper hand in a seller’s market, driving prices higher and creating a sense of urgency among buyers. In such scenarios, buyers must be prepared to act quickly and present strong offers to compete successfully. On the other hand, in a buyer’s market, buyers have more room to negotiate, potentially leading to lower prices and more favorable terms.

The Home Inspection and Appraisal Process

Not sure where to start in the home buying process? Have a look at this insightful article on Navigating the Real Estate Market: Tips for First-Time Homebuyers to get you on the right path.

What to Expect During a Home Inspection

One crucial step in the home buying journey is the home inspection. During this process, a qualified inspector will examine the property for any potential issues that may not be visible to the naked eye. This could include structural concerns, plumbing and electrical problems, or issues with the HVAC system. It’s crucial to be present during the inspection to ask questions and gain a better understanding of the home’s condition. The inspector will then provide a detailed report outlining any areas of concern, which can help you make an informed decision about moving forward with the purchase.

The Importance of Appraisal and Dealing with Discrepancies

Inspection and appraisal are two critical components of the home buying process. While the inspection focuses on the condition of the property, the appraisal determines the fair market value of the home. Lenders require an appraisal to ensure they are not lending more money than the property is worth. If discrepancies arise between the appraised value and the agreed-upon purchase price, it can create challenges for both parties. It’s crucial to work with your real estate agent to navigate these discrepancies and come to a resolution that works for all involved.

Financing Your Home

Understanding Different Mortgage Options

Your journey to homeownership begins with securing the right financing for your new home. With various mortgage options available in today’s real estate market, it’s vital to understand the differences between fixed-rate mortgages, adjustable-rate mortgages, FHA loans, and VA loans. Fixed-rate mortgages offer stability with consistent monthly payments, while adjustable-rate mortgages provide flexibility with potentially lower initial rates but the risk of rate increases in the future. FHA loans are ideal for first-time buyers with low down payment requirements, while VA loans offer exclusive benefits for veterans and active-duty military personnel.

Navigating Loan Approval and Closing Costs

Understanding the loan approval process and closing costs is crucial when purchasing your first home. Loan approval involves thorough scrutiny of your credit score, income, employment history, and debt-to-income ratio. Closing costs typically include fees for appraisal, title insurance, escrow, and attorney services. On average, closing costs can range from 2% to 5% of the home’s purchase price, so it’s important to budget accordingly. To streamline the process, work closely with your lender to ensure a smooth approval and closing process, eliminating any surprises along the way.

Preparing for Closing

Final Walkthrough and Addressing Last-Minute Concerns

To ensure a smooth closing process, it is imperative to conduct a final walkthrough of the property. This allows you to verify that the condition of the home is as agreed upon in the contract and address any last-minute concerns. Look out for any unexpected damages or changes that may have occurred since your last visit. It’s crucial to take this opportunity to confirm that any agreed-upon repairs have been completed satisfactorily.

The Closing Process: Documents, Payments, and What to Expect

For the closing process, you will need to gather all necessary documents, including identification, proof of insurance, and any other paperwork required by your lender. Be prepared to make the necessary payments, which may include down payment, closing costs, and any outstanding fees. During the closing, you will sign various legal documents, transfer ownership of the property, and make the final payment to complete the purchase.

Last-minute details can be stressful, but having a clear understanding of what to expect can help you navigate through the process confidently. Make sure to review all documents carefully, ask questions if anything is unclear, and be ready to provide any additional information or signatures as needed.

Moving In and Beyond

Once again, congratulations on purchasing your first home! Now that the deal is done and you have the keys in your hand, it’s time to focus on the next steps of moving in and settling into your new space. This exciting transition can also come with its fair share of challenges, from coordinating the logistics of the move to planning for long-term financial upkeep.

Planning Your Move: Logistics and Tips for a Smooth Transition

Logistics play a crucial role in ensuring a smooth and successful move into your new home. Start by creating a detailed moving checklist that includes tasks such as hiring a moving company, packing and labeling boxes, transferring utilities, and updating your address with important contacts like banks and insurance providers. Consider decluttering and organizing your belongings before the move to streamline the process and avoid bringing unnecessary items into your new space.

- Coordinate with your moving company well in advance to secure your desired moving date and ensure they have all necessary information for a seamless transition.

- Take precautions to protect your belongings during the move, such as using appropriate packing materials and labeling fragile items.

- Set aside a box of importants that you’ll need immediately upon moving into your new home, such as toiletries, a change of clothes, and important documents.

This attention to detail and proactive planning will help prevent any last-minute hiccups and make the moving process as stress-free as possible.

Home Maintenance and Long-Term Financial Planning

Your journey as a homeowner extends far beyond the initial purchase and move-in process. As you settle into your new home, it’s important to prioritize both short-term maintenance tasks and long-term financial planning to ensure the continued well-being of your property and investment.

Smooth operations at your newly purchased home require regular upkeep in the form of routine maintenance, such as cleaning gutters, servicing HVAC systems, and tending to landscaping. A proactive approach to home maintenance can help prevent costly repairs down the line and preserve the value of your home over time. In addition to maintenance tasks, it’s crucial to establish a long-term financial plan that accounts for ongoing expenses like property taxes, insurance, and emergency funds for unexpected repairs or upgrades.

Final Words

Considering all points, buying your first home is a significant milestone that comes with its challenges and decisions. It is important to carefully navigate the real estate market to ensure you make informed choices regarding your investment. From choosing the right location to securing financing and understanding the hidden costs involved, there are numerous factors to consider when purchasing a home.

By conducting thorough research, seeking advice from real estate professionals, and creating a budget, you can mitigate financial risks and make a well-informed decision. Remember that buying a home is a long-term commitment, so it is crucial to weigh all your options and prioritize what matters most to you. With careful planning and consideration, you can successfully navigate the real estate market and find the perfect first home that suits your needs and preferences.