There’s a growing trend of families living together across different generations, and with that comes the need for effective budgeting. You might wonder how to manage finances in a way that works for everyone involved. This blog will guide you on aligning financial goals within your multigenerational household. You’ll learn practical tips and strategies to create a budget that meets the diverse needs of your family members while promoting harmony and financial stability.

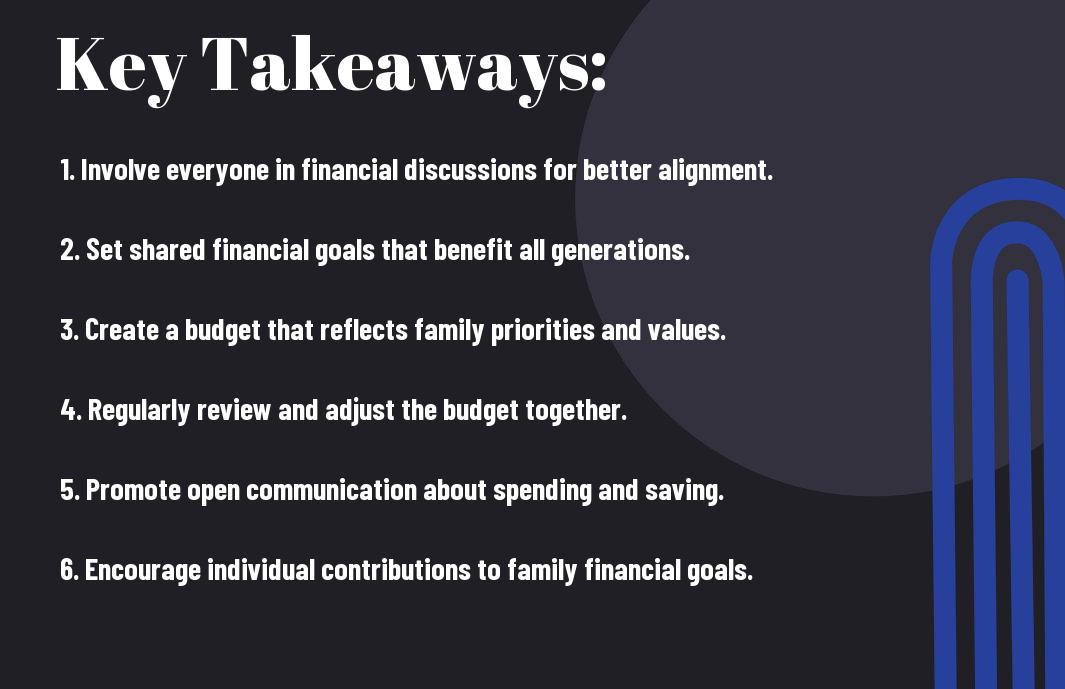

Key Takeaways:

- Engage in open discussions about financial goals among all family members. This ensures everyone is on the same page and helps build a shared vision for the future.

- Create a unified budget that caters to the needs and priorities of each generation. This promotes fairness and strengthens family ties.

- Regularly review and adjust the budget as needed. Life changes, and staying flexible allows the family to adapt to new circumstances and goals.

Understanding Multigenerational Families

To truly grasp the concept of multigenerational families, you should know that these families include relatives from different generations living together. This setup often involves grandparents, parents, and children sharing a single home. These families can offer more support and strengthen family bonds, but they also face unique financial challenges and opportunities.

Definition and Dynamics

Understanding multigenerational families means recognizing the various relationships that exist between family members. This family structure often has members from three or more generations living together. Each generation brings different life experiences and perspectives, creating a diverse household dynamic that can support each other in many ways.

Benefits and Challenges

Multigenerational families come with both benefits and challenges. You can enjoy shared resources, which may help reduce living costs. For instance, pooling your finances allows for better budgeting and savings. However, you might also experience conflicts over financial decisions, differing values, and varying spending habits. Discussing financial goals openly can help ease these challenges.

Plus, when you create a household with multiple generations, you gain various perspectives that enrich family life. You have the chance to learn from each other’s experiences and traditions. However, be prepared for potential misunderstandings, especially around money management. Setting clear financial goals together can create a path for harmony while achieving your joint objectives.

The Importance of Budgeting

Some families find budgeting to be a daunting task, but it’s vital for reaching your financial goals. By setting a budget, you can track your spending and save for future needs. This process can help align everyone’s financial objectives. For more insights, check out Creating a Multigenerational Wealth Plan: Ensuring Financial Security for Your Family.

Financial Stability

Beside helping you understand where your money goes, budgeting promotes financial stability. When you stick to a budget, you can manage your expenses better and avoid overspending. This approach allows all family members to contribute to common financial goals, building a solid foundation for future investments.

Reducing Stress

The act of budgeting can significantly reduce financial stress in your life. When you have a clear plan in place, you no longer need to worry about unexpected expenses or running out of money at the end of the month.

Indeed, budgeting gives you a sense of control over your finances. When you know where your money is going, you can make informed decisions and feel more secure about your future. This peace of mind can improve your overall well-being, allowing you and your family to focus more on what really matters.

Setting Common Financial Goals

Not everyone may see eye-to-eye when it comes to financial plans. To help align your family’s financial goals, consider how to balance financial priorities while sandwich parenting. Building consensus on these goals ensures that everyone is committed to the same vision, making it easier to manage your family’s finances collectively.

Identifying Priorities

Beside discussing your family’s goals, you should take time to identify what’s most important to each member. This can involve setting priorities for savings, debt management, and long-term investments. Each person’s perspective can help shape a balanced approach to budgeting.

Involving Everyone

Along with identifying priorities, it’s important to involve every family member in the budgeting process. This encourages open communication and allows everyone to share their financial aspirations. When each person has a voice, the family can work together more effectively.

At family budgeting meetings, provide space for each person to discuss their ideas and concerns. This collaborative atmosphere fosters understanding and trust. You might consider creating a shared document where everyone can contribute their thoughts. By doing this, you strengthen family bonds while developing a financial strategy that works for everyone.

Creating a Family Budget

Once again, budgeting is key when managing a multigenerational family. By aligning everyone’s financial goals, you can create a family budget that suits all members. Start by discussing priorities as a group. This way, everyone has a voice in the process. For more details, you can check this Financial Planning for Multigenerational Households article.

Gathering Financial Data

The first step in creating a family budget is to gather financial data. Collect information about income, expenses, and savings from all family members. Having a clear picture of your combined finances helps you make informed decisions. Be open and honest about your financial situation to build trust and ensure everyone is on the same page.

Allocating Resources

After gathering your financial data, you need to allocate resources effectively. Decide how much money each area, such as housing, groceries, and entertainment, should receive. It is important to find a balance that supports the needs of everyone in the family while still allowing for savings.

Data shows that families who set clear spending limits tend to reach their financial goals faster. Track your expenses regularly to see if you are on target. Adjust allocations as needed to keep your budget balanced. Encourage all family members to participate in spending decisions. This foster’s a sense of ownership and helps you all stay accountable.

Tools and Resources for Budgeting

Now that you’re ready to tackle multigenerational family budgeting, it’s important to find the right tools and resources to help you along the way. Using these tools can make the budgeting process easier and more effective. Whether you prefer digital solutions or traditional methods, having the right resources will keep your family aligned with your financial goals. Let’s explore some of the best options available.

Budgeting Apps

Tools like budgeting apps can simplify your financial planning. Many apps are designed for families, enabling you to track expenses, set savings goals, and share your budget with other family members. Popular apps like Mint and EveryDollar offer user-friendly interfaces and helpful features. You can sync your bank accounts to get real-time updates on your spending. This keeps everyone on the same page and helps you stay accountable.

Traditional Methods

Budgeting doesn’t always have to be digital. You can also use traditional methods like pen and paper, spreadsheets, or whiteboards. These methods allow you to visualize your budget clearly. Writing everything down helps you understand your spending habits and prompts important discussions among family members. You can create a physical budget board where everyone can see the goals and progress. This tactile approach ensures that your family’s financial objectives are at the forefront of your daily life.

With traditional methods, you have the flexibility to customize your budgeting process. You can choose simple worksheets or create complex spreadsheets that work specifically for your family’s needs. Using a shared space like a kitchen table can also foster communication when discussing expenses and goals. Budgeting in this way encourages family members to participate, ensuring that everyone feels included and informed about financial decisions.

Regular Review and Adjustment

Despite having a well-planned multigenerational family budget, it’s important to regularly review and adjust it. Life is full of changes that can affect your financial goals. By consistently checking in, you ensure your budget reflects your current situations and priorities. This practice keeps everyone aligned and engaged in reaching your shared financial ambitions.

Monthly Check-Ins

Review your budget each month with your family. This meeting allows everyone to discuss their expenses, savings, and any changes in financial goals. Open communication helps you stay on the same page and prevents misunderstandings about money. By including everyone in the process, you build a sense of teamwork and accountability within your family.

Adapting to Changes

Regularly adjusting your budget is vital for staying on track. When unexpected expenses arise, or if someone in your family’s financial situation changes, your budget should reflect these new realities.

Another point to consider is that life events like job changes, illnesses, or education costs can shift your financial landscape. By proactively discussing these changes in your monthly check-ins, you can adapt your budget effectively. This flexibility allows your family to respond to challenges calmly and keeps everyone motivated. Make it a habit to reassess your financial goals together, ensuring they align with your current realities.

Final Words

With these considerations, you can align financial goals within your multigenerational family. Start by openly discussing your family’s financial situation and individual objectives. Make sure everyone feels heard and involved in the budgeting process. Regularly review your budget together to track progress and adjust as needed. This cooperative approach not only strengthens family bonds but also leads to better financial outcomes for everyone involved. By working together, you create a supportive environment for achieving your financial goals.

FAQ on Multigenerational Family Budgeting – Aligning Financial Goals

Q: What is multigenerational family budgeting?

A: Multigenerational family budgeting is when multiple generations of a family work together to create a budget that meets everyone’s financial needs. This includes grandparents, parents, and children. Each person’s income, expenses, and goals are considered. This approach helps families save money and reach shared financial goals more effectively.

Q: Why is aligning financial goals important in a multigenerational family?

A: Aligning financial goals helps all family members understand each other’s priorities. When everyone is on the same page, it creates teamwork and reduces misunderstandings. This can lead to better financial decisions, such as saving for shared expenses like vacations, college funds, or home repairs. It also fosters a sense of unity among family members.

Q: How can a family start a multigenerational budget?

A: To start a multigenerational budget, follow these steps:

- Schedule a family meeting where everyone can participate.

- List all income sources and monthly expenses for each member.

- Discuss financial goals together, both short-term and long-term.

- Assign responsibilities, such as who will track spending or make adjustments.

- Create a budget document that everyone can access and update.

This process helps ensure that everyone is involved and invested in the family’s financial success.

Q: What are some common challenges in multigenerational family budgeting?

A: Families may face several challenges, including:

- Differences in financial priorities among generations.

- Communication issues that can lead to misunderstandings.

- Varied spending habits that might clash.

- Resistance to sharing financial information.

Overcoming these challenges requires open discussions and a willingness to compromise.

Q: How can families improve communication about money?

A: Improving communication about money can be done by:

- Holding regular discussions about spending and savings.

- Using clear language and avoiding financial jargon.

- Encouraging everyone to share their thoughts and feelings about the budget.

- Setting family rules for money management that everyone agrees on.

By fostering a safe space for open dialogue, families can build trust and work better together on their finances.

Key Takeaways

- Teamwork: Multigenerational budgeting promotes collaboration among family members.

- Understand Each Other: Aligning financial goals helps reduce misunderstandings.

- Open Communication: Regular discussions about finances build trust and improve teamwork.

- Adaptability: Be willing to adjust the budget as family needs change.

Use these tips to take control of your family’s finances together. A solid budget can help your entire family achieve more financial stability and shared dreams!