Most people often confuse the terms self-employed and freelancer, but your tax obligations can vary significantly between the two. Understanding these differences is important for managing your finances effectively. Whether you freelance on platforms or run your own business, knowing how to handle your taxes will help you avoid issues with the IRS. In this blog post, we’ll break down what you need to know about your tax responsibilities, so you can stay compliant and keep more of your hard-earned money.

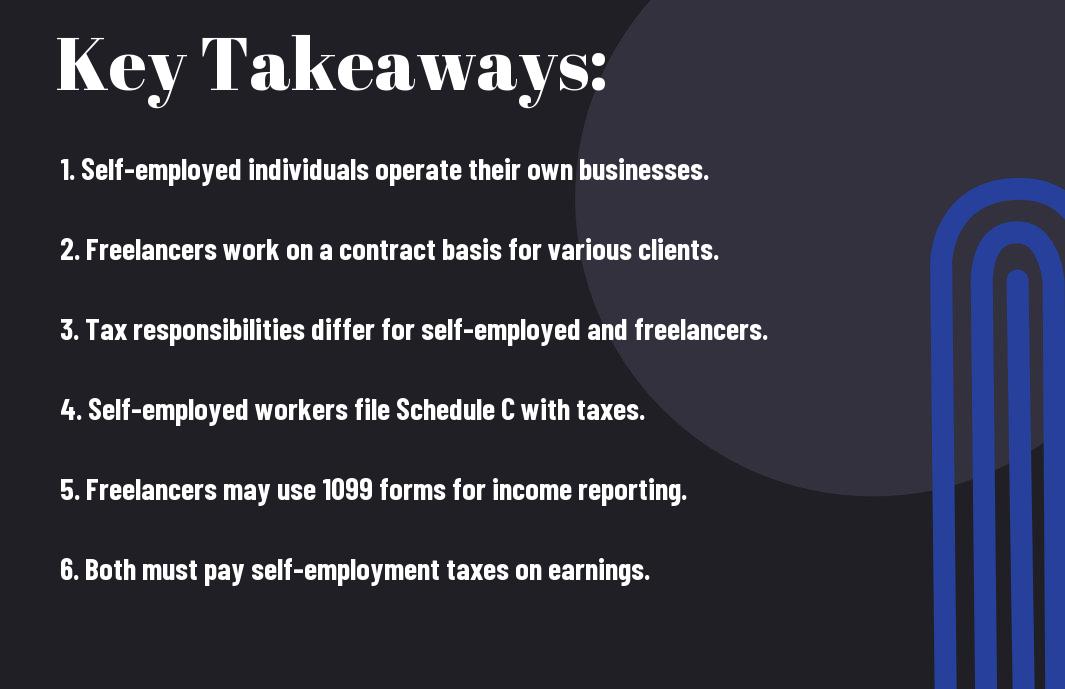

Key Takeaways:

- Self-employed individuals and freelancers both report their income differently on tax returns. Understanding these differences can help you file accurately.

- Self-employed people may need to pay estimated taxes quarterly. Freelancers often have different options based on their income and the way they receive payments.

- Both self-employed individuals and freelancers can deduct business expenses. Keeping good records of these costs can help reduce your overall tax bill.

Understanding Self-Employment

For many people, self-employment offers flexibility and independence. You set your own hours and choose your projects. However, it also comes with specific responsibilities, especially regarding taxes. Knowing what self-employment means is your first step in navigating these responsibilities.

Definition of Self-Employed

Below, self-employed means you work for yourself instead of someone else. You run your own business or offer services directly to clients. Your income comes from your efforts, not a traditional paycheck.

Common Types of Self-Employment

Against popular belief, self-employment can take many forms. Common types include freelancers, consultants, and small business owners. Each type has unique tax obligations and financial management needs. Here are a few examples:

- Freelancers provide services on a project basis.

- Consultants offer expertise in a specific field.

- Independent contractors work on contracts for various clients.

- Small business owners run their own storefronts or online shops.

- Gig workers complete short-term tasks through apps or platforms.

Any self-employment type has its own tax rules that you must follow.

| Type of Self-Employment | Common Tax Considerations |

|---|---|

| Freelancer | Report income as self-employment income |

| Consultant | Possible deductions for business expenses |

| Independent Contractor | Issuance of 1099 forms for income over $600 |

| Small Business Owner | Sales taxes and employee taxes may apply |

| Gig Worker | Consideration of fluctuating income for tax purposes |

Indeed, understanding these different forms of self-employment is important for managing your tax obligations. Not only do each of these types come with specific financial skills, but you also need to know what deductions you can claim. Here are some key points:

- You must track your expenses to maximize deductions.

- Keep records for accurate reporting.

- Understand when to pay estimated taxes.

- Research your industry for specific tax breaks.

- Consider hiring a tax professional if needed.

Any self-employed person can benefit from being proactive about their taxes.

| Key Point | Why It Matters |

|---|---|

| Track Expenses | Helps reduce taxable income |

| Keep Records | Ensures accuracy and compliance |

| Pay Estimated Taxes | Prevents penalties for underpayment |

| Research Tax Breaks | Maximizes your savings |

| Hire a Professional | Makes the process easier and less stressful |

What Is Freelancing?

Some people often wonder what freelancing really means. It involves working for yourself, usually by providing services to different clients instead of having a traditional job. Freelancers typically have the flexibility to choose their projects, which can lead to a more diverse work experience. For more information on how freelancing differs from being an employee, check out this Employee vs. Freelancer: Tax and Financial Implications.

Definition of Freelancer

By definition, a freelancer is someone who earns money by providing services to clients without being tied to a single employer. You can work in various fields, and you typically control your workload and schedule. Freelancers often get paid based on contracts, which outlines the work agreement.

Popular Freelancing Fields

Any freelancer can find work in many areas. Some popular fields include writing, graphic design, web development, and marketing. These industries are in high demand, making freelancing appealing for many individuals. You can tap into your skills and interests to carve out your niche.

Freelancing allows you to engage in various tasks according to what interests you. For example, if you are good at writing, you might create articles or content for websites. If you have a knack for design, you could develop logos or social media graphics. This diversity enables you to build a portfolio that showcases your abilities, helping you attract more clients.

Tax Obligations for Self-Employed Individuals

All self-employed individuals have specific tax obligations that differ from traditional employees. You need to report your earnings and pay self-employment taxes, including Social Security and Medicare. Unlike employees, you won’t have someone withholding taxes from your paycheck. You are responsible for keeping track of your income and paying taxes directly to the IRS. Understanding these responsibilities will help you avoid penalties and manage your finances better.

Reporting Income

Self-employed individuals must report all your income to the IRS, even if you earn cash. This includes any money received from clients and side jobs. You’ll typically receive a 1099 form from clients who pay you over $600. It’s important to keep organized records so that you can accurately report your total income when tax season arrives.

Deductions and Expenses

Among the benefits of being self-employed are the deductions and expenses you can claim on your taxes. These can significantly lower your taxable income, which means you may pay less in taxes. You can deduct costs related to your business, such as equipment, supplies, and even a portion of your home office if you work from home. Keeping detailed records of all your business-related expenses will help you maximize your deductions.

Deductions can include various expenses such as travel, meals, and advertising. For instance, if you traveled for a client meeting, you could deduct the travel costs. Likewise, if you purchased a new computer for work, that cost is also deductible. By tracking these expenses closely, you can reduce your tax burden and keep more money in your pocket at the end of the year.

Tax Obligations for Freelancers

Now that you understand the difference between self-employed individuals and freelancers, it’s important to know your tax obligations as a freelancer. Unlike traditional employees, you are responsible for managing your own taxes. This includes keeping track of your income, expenses, and filing your tax return on time. It’s vital to have a good system for documenting your financial activities to avoid issues down the road.

Reporting Income and Taxes

Any income you earn as a freelancer must be reported to the IRS. This includes money from various projects or clients. It’s important to keep accurate records of all payments, since you will use this information when filing your taxes. You typically use a Schedule C form to report your earnings and expenses. If you earn $600 or more from a single client, they will issue you a Form 1099-NEC, which also needs to be reported.

Common Deductions for Freelancers

Before you file your taxes, you should be aware of the common deductions available to you as a freelancer. These can help reduce your taxable income. Common deductions include expenses related to your home office, internet, software, and any materials you purchase for your work. Keeping receipts and detailed records of these expenses is key to maximizing your deductions.

Even if your income fluctuates, you can often deduct many business-related expenses. For instance, if you use a part of your home exclusively for work, you may qualify for a home office deduction. Further, costs like business cards, website hosting, and even a portion of your phone bill can significantly reduce your taxable income. Make sure to consult with a tax professional to help identify all possible deductions and ensure you’re taking full advantage of the savings available to you.

Key Differences in Tax Responsibilities

Many people often confuse being self-employed with freelancing, but your tax responsibilities can differ significantly. As a self-employed individual, usually, you run your own business, while freelancers generally offer services on a project basis. Your taxes will reflect these differences, affecting how you file and pay taxes. Understanding these distinctions can help you better manage your finances and avoid any unwanted surprises during tax season.

Self-Employment Tax Rates

Differences in self-employment tax rates can impact how much you owe. Typically, self-employed individuals pay a 15.3% self-employment tax, which includes Social Security and Medicare taxes. Freelancers may see similar rates, but how you report your income might vary based on your business structure.

Estimated Tax Payments

Self-employment often requires you to make estimated tax payments throughout the year. This means you need to pay taxes quarterly rather than just once a year. These payments help cover your income tax and self-employment tax, preventing a large bill when you file your annual return.

Understanding estimated tax payments is important for managing your cash flow. You will need to calculate your expected income and expenses to estimate what you owe. The IRS allows you to use Form 1040-ES to guide you. By making these payments on time, you avoid penalties and interest charges. Keeping track of your income and expenses throughout the year can make this process smoother and alleviate stress at tax time.

Tips for Managing Your Taxes

Keep your tax situation in check by following these tips:

- Set aside money for taxes regularly.

- Keep track of all business expenses.

- Consult a tax professional if you need guidance.

- File your taxes on time to avoid penalties.

Recognizing these steps can help you stay organized and reduce stress during tax season.

Keeping Accurate Records

Among the most important parts of managing your taxes is keeping accurate records of your income and expenses. You should document every transaction related to your business. This includes invoices, receipts, and bank statements. The more organized your records are, the easier it will be to file your taxes. Remember that the IRS requires you to keep these records for several years, so maintain them in a safe location.

Using Accounting Software

On the other hand, using accounting software can make your tax management much easier. These programs help you track your income and expenses in real time, reducing the risk of errors. They can automate calculations and even remind you of deadlines. By integrating your bank accounts and credit cards, you can get a comprehensive view of your finances.

To maximize the benefits of accounting software, choose one that fits your specific needs as a self-employed individual or freelancer. Look for features like invoicing, expense tracking, and tax preparation support. Many options available today offer affordable plans and user-friendly interfaces. This way, you can focus on your work without worrying about tax time hassles.

Final Words

On the whole, understanding the differences in tax obligations between being self-employed and a freelancer can help you stay organized and compliant. As you navigate your business journey, it’s important to keep accurate records and know which tax forms to use. If you want to dive deeper into this topic, check out The freelancer’s guide to taxes | How to do taxes as a … for more detailed information. By staying informed, you can manage your taxes confidently and effectively.

FAQ

Q1: What is the difference between being self-employed and a freelancer?

A: Being self-employed means you own your own business. You might have clients or customers, but you are responsible for all aspects of the business. A freelancer is also self-employed, but they usually work on a project basis for different clients. Freelancers often provide specific services, like writing or graphic design, without a long-term commitment to any one client.

Q2: How do tax obligations differ for self-employed and freelance workers?

A: Both self-employed individuals and freelancers must pay self-employment taxes, which cover Social Security and Medicare. However, self-employed people might have more complicated tax situations because they may need to account for business expenses, employees, or self-funded retirement plans. Freelancers often have simpler taxes, focusing on income and direct expenses related to their freelance work.

Q3: What tax forms do I need to fill out if I am self-employed?

A: If you are self-employed, you typically need to fill out Schedule C (Profit or Loss from Business) when you file your taxes. You will also need to complete Schedule SE (Self-Employment Tax) to calculate your self-employment tax. Keep records of your income and expenses to make this easier.

Q4: Do self-employed individuals qualify for business deductions?

A: Yes, self-employed individuals can claim a variety of business deductions. These might include costs like office supplies, travel expenses, and even part of your home if you use it for business. Freelancers can also claim many of the same deductions, but it’s important to keep detailed records of all expenses.

Q5: How can I ensure I am paying enough taxes as a self-employed or freelance worker?

A: It is a good practice to set aside a portion of your income for taxes. A common guideline is to save about 25-30% of your earnings. To avoid any surprises, consider making estimated tax payments throughout the year. Consulting with a tax professional can also help you stay on track and ensure you meet all your tax obligations.