Over the years, many individuals have dedicated their careers to public service, making a significant impact in their communities. If you are one of them, you may be eligible for the Public Service Loan Forgiveness (PSLF) program. This blog post will explain who qualifies for PSLF and how the process works. You’ll learn the steps to take and the benefits of this program, helping you to possibly erase your student loan debt while serving the public good.

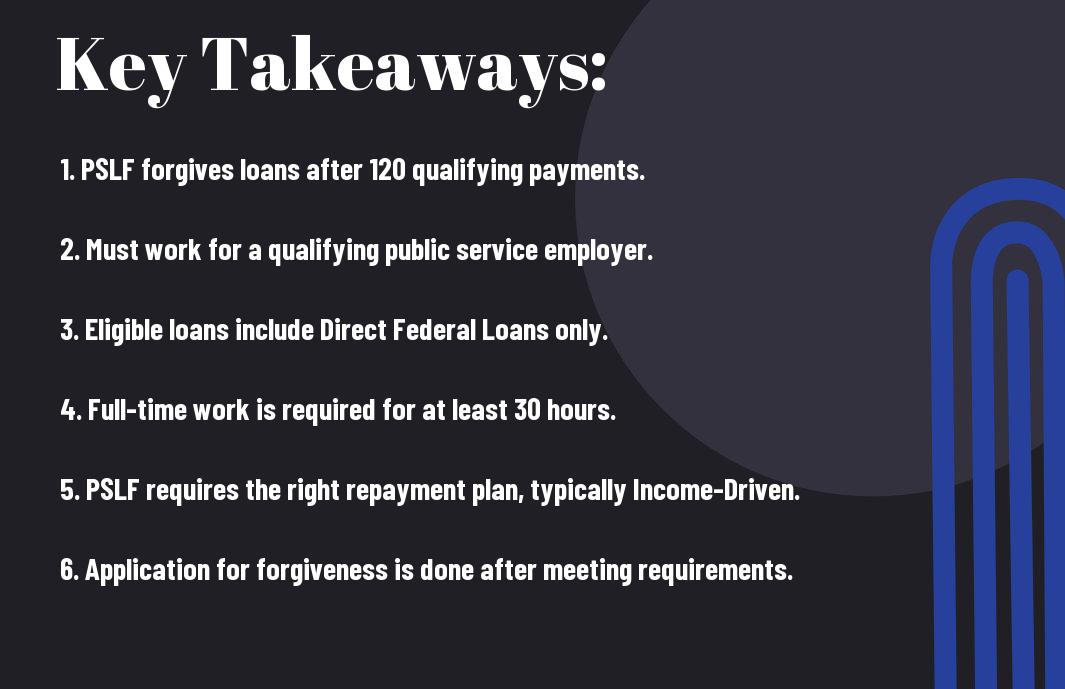

Key Takeaways:

- Public Service Loan Forgiveness (PSLF) is available to borrowers working full-time for qualifying government or nonprofit organizations, making on-time payments for 120 months.

- Eligible loans include Direct Loans; other loans may need to be consolidated into a Direct Consolidation Loan to qualify for forgiveness.

- Stay informed about your eligibility, apply for forgiveness through your loan servicer, and keep all documentation handy to ensure a smooth process.

What is Public Service Loan Forgiveness (PSLF)?

For many borrowers, Public Service Loan Forgiveness (PSLF) is a valuable program designed to help you eliminate your student debt. This program is specifically for those working in public service jobs, such as teachers, nurses, and government employees. If you qualify, you could have your federal student loans forgiven after making consistent payments for a set period.

Definition of PSLF

Around 2007, the federal government introduced the Public Service Loan Forgiveness (PSLF) program to encourage graduates to pursue careers in public service. This program forgives the remaining balance on your Direct Loans after you make 120 qualifying monthly payments while working full-time for a qualifying employer.

Overview of Loan Forgiveness

With PSLF, you can have a significant portion of your student loans forgiven if you meet specific criteria. To qualify, you must work in a government or non-profit organization, make 120 qualifying payments on your loans, and be enrolled in a qualifying repayment plan. This means you could be debt-free in ten years while contributing to your community.

Overview, the PSLF program allows you to manage your student loans effectively while making a positive impact in your field. You must ensure that you are in a qualifying repayment plan, such as Income-Driven Repayment (IDR). Staying informed and organized throughout your repayment process can streamline your journey to loan forgiveness and reduce financial stress.

Eligibility Requirements

There’s a clear set of rules to qualify for Public Service Loan Forgiveness (PSLF). To be eligible, you need to work full-time in a qualifying job and make 120 qualifying monthly payments towards your loans. Moreover, your loans must be federal Direct Loans. Make sure you understand these requirements before applying for forgiveness. Meeting these conditions is key to easing your student debt burden.

Qualifying Jobs

Along with meeting payment requirements, you must work in a qualifying job. Acceptable positions include those in government organizations, non-profit organizations, and certain educational or health service sectors. Your work should focus on serving your community and helping those in need. If your job aligns with these areas, you might be on your way to loan forgiveness.

Eligible Loan Types

An important part of the PSLF process involves knowing which loans qualify. Only federal Direct Loans are eligible. This includes Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans, and Direct Consolidation Loans. Other types of federal student loans, like FFEL and Perkins Loans, do not qualify unless you consolidate them into a Direct Loan. To help you understand better, here’s a breakdown:

| Loan Type | Eligibility Status |

|---|---|

| Direct Subsidized Loans | Eligible |

| Direct Unsubsidized Loans | Eligible |

| Direct PLUS Loans | Eligible |

| Direct Consolidation Loans | Eligible |

| FFEL Loans | Not Eligible |

But knowing about eligible loans is just the start. You also need to be proactive about your loan type to ensure you can get PSLF benefits. Look at your loan statements closely or speak to your loan servicer to clarify your loan types. Here’s a list of crucial points to keep in mind:

- Confirm your loans are Direct Loans.

- Consider consolidating non-Direct Loans.

- Make sure you are using the right repayment plan.

- Stay updated on your payment status.

- Any change in employment should be reported immediately.

The Application Process

All applicants for the Public Service Loan Forgiveness (PSLF) program must follow a specific process to ensure their loans qualify for forgiveness. This involves completing the necessary forms and working with a qualified employer. You can find more information about Qualifying Public Services for the Public Service Loan Forgiveness on the official Student Aid website.

Steps to Apply

Beside filling out the right forms, you need to verify your employment. First, complete the Employment Certification Form. You will need to get your employer to sign it. Then, submit this form regularly to track your qualifying payments.

Important Documents Needed

For your application, you will need specific documents to prove your eligibility. This generally includes pay stubs, W-2 forms, and a copy of the Employment Certification Form. These documents help verify your employment with a qualified public service organization.

At the time of application, ensure you have all required documents organized. Pay stubs prove your income, while W-2 forms show your tax contributions. Collecting and submitting these items accurately is crucial for a smooth application process. Make copies for your records, as you may need them in the future.

Payment Requirements

Keep in mind that to qualify for Public Service Loan Forgiveness (PSLF), you must meet specific payment requirements. These include making 120 qualifying payments while working full-time for a qualifying employer. It’s important to stay on top of your loans and ensure each payment is made on time to maintain your progress toward forgiveness.

Qualifying Payments

Payment counts toward the PSLF program only if you make on-time payments under a qualifying repayment plan. This means each payment must be made in full and within the month it is due. Payments made on loans that are in deferment, forbearance, or default will not count. Keeping track of your payments is imperative.

Repayment Plans

For your payments to qualify, they must be made under a specific repayment plan. PSLF accepts plans like Income-Driven Repayment (IDR), which bases your monthly payment on your income. You can choose a plan that fits your financial situation best, ensuring you stay on track for forgiveness.

In addition, choosing an IDR plan can help lower your monthly student loan payments, making them more manageable. This can be especially helpful if you are earning a lower salary in your public service role. By selecting the right repayment plan, you not only reduce your financial burden but also set yourself up for successful loan forgiveness.

Common Myths about PSLF

Once again, many people hold misconceptions about the Public Service Loan Forgiveness (PSLF) program. These myths can create confusion and discourage eligible borrowers from applying. For instance, some believe that all federal loans qualify, while others think they need to make payments for 20 years. Understanding the truth is important to take advantage of this benefit effectively.

Debunking Misconceptions

Above all, it’s important to separate fact from fiction regarding PSLF. One common myth is that you must work in a certain job type for forgiveness. In reality, any full-time job for a qualifying employer counts. This means lots of opportunities for you!

Understanding the Reality

After debunking myths, it’s time to look at the facts of PSLF. Many people think it’s hard to qualify, but if you’re working for a government or nonprofit organization, you might be closer than you think. The key is to ensure your loan type meets the criteria, and you’re making qualifying monthly payments.

Another aspect you should know is that the process can feel overwhelming, but you can simplify it. Keep track of your payments and submit the Employment Certification Form regularly. This helps confirm that you’re on the right path toward forgiveness. Plus, more than 500,000 borrowers have had their loans forgiven through PSLF as of October 2023, showing that success is possible with the right steps.

Tips for Successful Application

Unlike many loan programs, the Public Service Loan Forgiveness (PSLF) has specific requirements. To increase your chances of a successful application, follow these tips:

- Double-check your employment qualifications.

- Ensure your loans are eligible for forgiveness.

- Make timely payments on your qualifying loans.

- Submit your PSLF form annually to track progress.

After following these steps, you’ll have a better chance of qualifying for loan forgiveness.

Keeping Records

Before applying for PSLF, keep thorough records of your employment and payments. Save pay stubs, W-2 forms, and any correspondence with your loan servicer. This documentation will help you prove your eligibility and support your application effectively.

Seeking Help and Resources

Along the way, it’s beneficial to seek help and resources. The PSLF process can be complicated, and assistance can make it easier to navigate.

But don’t hesitate to reach out for support. Organizations like the Student Loan Borrower Assistance and even your loan servicer can provide valuable information. Online forums and local workshops may also offer insights from others who have successfully gone through PSLF. By accessing these resources, you can address any questions or concerns you have, making your application journey smoother.

Summing up

With these considerations, you can better understand the Public Service Loan Forgiveness (PSLF) program. If you work for a qualifying employer and make 120 qualifying payments on your Direct Loans, you could potentially have your remaining balance forgiven. Make sure to regularly submit your Employment Certification Forms to track your progress. This program can significantly ease your student loan burden, allowing you to focus more on your service and less on your finances.

FAQ: Public Service Loan Forgiveness (PSLF) – Who Qualifies and How It Works

Q: What is Public Service Loan Forgiveness (PSLF)?

A: Public Service Loan Forgiveness (PSLF) is a federal program that helps borrowers get their federal student loans forgiven after making payments for a certain period. To qualify, you must work full-time in a public service job and make 120 qualifying monthly payments under a qualifying repayment plan.

Q: Who qualifies for PSLF?

A: To qualify for PSLF, you must meet these criteria:

- You must work full-time for a qualifying employer, such as government organizations or non-profit organizations.

- You must have Direct Loans. If you have other types of loans, consider consolidating them into a Direct Consolidation Loan.

- You must make 120 qualifying payments on your loans while working for a qualifying employer.

- Your payments must be made under a qualifying repayment plan, like an Income-Driven Repayment plan.

Q: How do I apply for PSLF?

A: To apply for PSLF, take these steps:

- Fill out the PSLF form to confirm your employment. You can find it on the Federal Student Aid website.

- Submit the form to FedLoan Servicing, the company that manages PSLF.

- Keep track of your payments and your employment status every year to ensure you meet the requirements.

Q: How does the repayment process work for PSLF?

A: Here is how the repayment process works for PSLF:

- You must make 120 monthly payments that are on time and equal to what you owe under your repayment plan.

- These payments do not have to be in a row, but they must be paid while you are employed full-time at a qualifying employer.

- Only payments made after October 1, 2007, count toward the 120 payments.

- If you meet all the requirements, the remaining balance on your Direct Loans can be forgiven.

Q: What should I do if my application for PSLF is denied?

A: If your PSLF application is denied, you should:

- Carefully review the reason for the denial. It may be due to missed payments or not working for a qualifying employer.

- Fix any issues. If you were not enrolled in a qualifying repayment plan, consider switching plans or consolidating your loans.

- Resubmit your application after addressing the problems. You can also appeal the decision if you believe it was made in error.

Key Takeaways

Public Service Loan Forgiveness can help borrowers reduce their student loan burden significantly. To qualify, you must work in public service and meet several requirements. Keep thorough records of your payments and employment to make applying easier. If you face challenges, take steps to resolve them. Stay informed and proactive to make the most of this valuable program.