Just like any popular trend, the Financial Independence, Retire Early (FIRE) movement has its share of myths. You may have heard some misconceptions that can cloud your understanding of what FIRE really is. In this post, we’ll uncover the truth behind these common myths. By clearing up these misunderstandings, you can make informed decisions about your financial future and explore whether this movement is right for you.

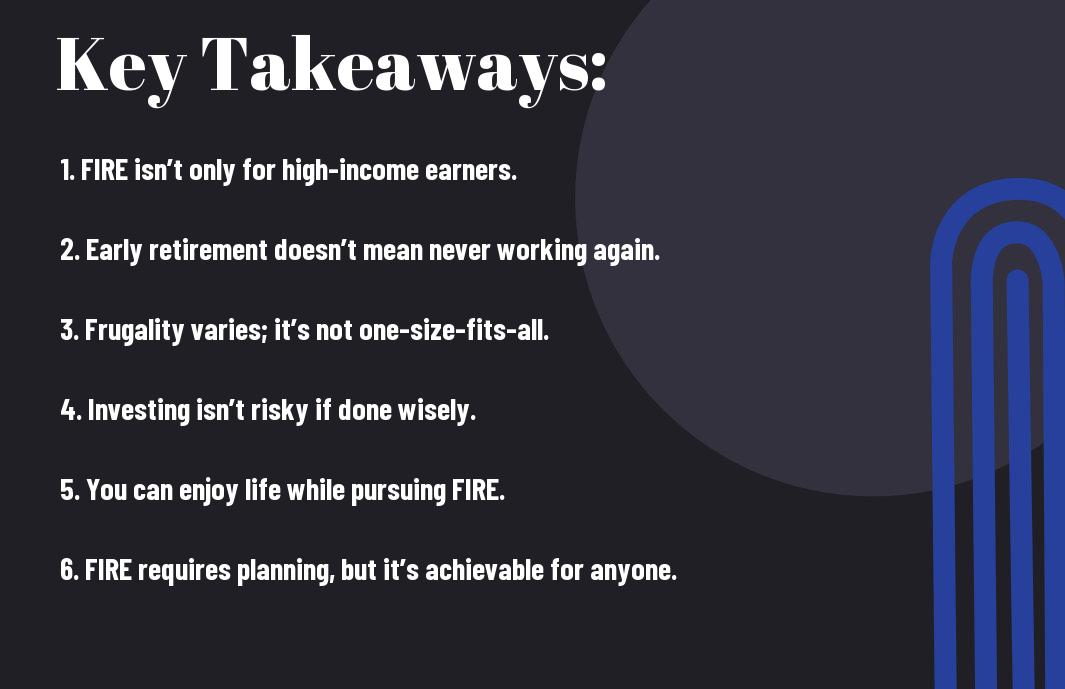

Key Takeaways:

- The FIRE (Financial Independence, Retire Early) movement focuses on saving and investing a significant portion of your income to achieve financial freedom sooner than the traditional retirement age.

- Many myths surround the FIRE movement, such as the belief that you must live frugally forever, but it actually encourages smart spending and enjoying life once your goals are met.

- FIRE is not just for high earners; anyone can adopt its principles with proper planning and dedication, regardless of their income level.

FIRE Means Retiring Early

Before you explore the FIRE (Financial Independence, Retire Early) movement, it’s important to understand that it doesn’t always mean you will completely stop working. Many people think that achieving FIRE guarantees an early retirement, but this is not the full story.

Not Always True

Clearly, the idea of retiring early can be misleading. Achieving financial independence gives you the freedom to choose how you spend your time. This does not necessarily have to be a life without work. Many people enjoy working in some capacity after reaching their FIRE goal.

Many Still Work Part-Time

Little do many people know, a lot of those who achieve FIRE choose to pursue part-time work or freelance opportunities. They often do this to stay engaged and fulfill their passions without the stress of a full-time job.

For instance, you might find someone who has reached FIRE deciding to start a small business, become a consultant, or engage in freelance writing. This flexible work allows you to enjoy life on your terms while still bringing in income. It can also help you stay socially connected and mentally stimulated during your early retirement years.

You Must Earn a Lot

You might think that to join the FIRE movement, you need to have a high-paying job. This is a common myth. In reality, many people on the FIRE path come from various income backgrounds. It’s not just about how much you earn. Instead, it’s about how you manage your money and make smart choices.

Income Isn’t Everything

On your journey to financial independence, you may feel pressured to chase a high income. However, focusing solely on earning can lead to stress and burnout. It’s better to aim for a balanced approach that considers your spending, saving, and investing habits. Building wealth is about making informed decisions, not just chasing a paycheck.

Saving Matters More

Now, you should focus on saving, which has a bigger impact on your financial journey than simply earning a lot. It’s important to develop good saving habits and set aside a portion of your income regularly. This discipline can help you build a solid financial foundation and achieve your goals faster. By prioritizing saving over the quest for a higher salary, you’ll gain more control over your financial future.

Income plays a role in your financial journey, but it’s not the only factor. Salary increases can help, but if you don’t save wisely, you might not maximize those earnings. By adopting a frugal lifestyle and creating a budget, you can stretch your dollars further. Smart saving can lead to financial freedom, regardless of your income level. Focus on how much you save and invest, and you may find yourself closer to your FIRE goals.

It’s Only for the Wealthy

To many, the FIRE movement may seem like a dream for the wealthy. People often think that only those with high incomes can retire early. This idea can be misleading. In reality, you can start your journey to financial independence with any income. It’s all about how you manage your money and plan for the future.

Accessible to Anyone

There’s a common misconception that financial independence is out of reach for most people. The truth is, anyone can pursue the FIRE movement, regardless of your starting point. With smart budgeting, saving, and investing, you can build wealth over time. It’s about creating a lifestyle that supports your goals, not just about having a large paycheck.

Focus on Budgeting

Wealthy individuals may have more resources, but effective budgeting is where financial independence truly begins. You need to track your expenses, cut unnecessary costs, and find ways to save money. The goal is to increase your savings rate, helping you reach your FIRE goals sooner. By being mindful of how you spend, you can live well below your means and create a solid foundation for your financial future.

It’s important to set a realistic budget that reflects your income and expenses. Create a spending plan that prioritizes savings. Consider dining out less or finding cheaper alternatives for daily expenses. Every little bit adds up. As you improve your budgeting skills, you’ll feel more in control of your finances. This approach makes the FIRE movement accessible, even if you don’t have a high income.

Only Extreme Frugality Works

Despite what some might say, you don’t have to live in extreme frugality to succeed in the FIRE movement. Many people think they must cut out all luxuries, but that isn’t necessary. You can still save a significant amount while enjoying the things you love. It’s about finding the right balance between saving and spending. A healthy approach can lead to financial independence without sacrificing your happiness.

Balance is Key

To truly thrive in the FIRE movement, you must find a balance that works for you. This means making smart spending choices while still enjoying life. Instead of going to extremes, focus on strategies that allow you to save money without feeling deprived. Assess your spending and prioritize what truly matters to you; this will help you stay motivated on your journey to financial independence.

Enjoy Life Now

For many people on the FIRE journey, enjoying life now is just as important as saving for the future. You don’t have to wait until you retire to have fun. Life can be fulfilling today if you make mindful choices about your finances. Small adjustments in your daily habits can lead to a happier, more balanced life while still working toward your financial goals.

Life is about experiences, and you shouldn’t put everything on hold while pursuing financial independence. It’s perfectly okay to treat yourself and create memories along the way. Enjoying life now can mean taking affordable trips, exploring new interests, or simply spending time with loved ones. The key is to ensure your choices align with your financial goals. Balance enjoying your present with future savings, and you’ll find that the FIRE movement can coexist with a vibrant lifestyle.

You Can’t Spend Money

After starting your journey toward financial independence, you might hear the myth that you can’t spend any money. This misconception can make the FIRE movement seem harsh and unappealing. In reality, the goal is to find a balance between saving and enjoying your life. You don’t have to live like a hermit to achieve financial freedom. Instead, many people discover ways to enjoy themselves without overspending.

Controlled Spending Allowed

Allowed in the FIRE movement is the concept of controlled spending. It emphasizes being mindful of your purchases while still enjoying life. You can create a budget that includes funds for both saving and spending on the things you love. This balance ensures you still get to enjoy life while working toward your financial goals.

Enjoyment Can Fit Budget

To make your budget enjoyable, focus on what truly brings you happiness. Spending on experiences that matter to you can fit nicely into your financial plan. This could mean planning a trip, enjoying a nice dinner, or engaging in hobbies. The key is to prioritize your spending based on your values, so you don’t feel deprived.

Cant’ stress enough the importance of aligning your spending with your personal values. Consider what activities make you feel good and invest in those areas. By prioritizing meaningful experiences, you can enjoy life while still being financially responsible. Balancing your budget means sacrificing some wants, but it doesn’t mean living a joyless life. You can still have fun while working toward your financial independence goals.

It Guarantees Happiness

Your journey in the FIRE movement might lead you to believe that reaching financial independence will automatically make you happy. However, this is a myth. While financial freedom can reduce stress and provide more options, it does not guarantee lasting happiness. You still need to find fulfillment in your life beyond just money.

Happiness is Subjective

Guaranteed happiness is a misconception. Everyone experiences joy differently. What makes you happy may not work for someone else. It’s important to discover what true happiness means to you, beyond financial goals.

Lifestyle Changes Affect Joy

To achieve financial independence, you may need to make significant lifestyle changes. These changes can impact your daily happiness. If you prioritize saving and cutting expenses, you might lose out on activities or experiences that bring joy.

The adjustments you make in pursuit of FIRE can either enhance or diminish your joy. For instance, while moving to a cheaper area can save money, it might also mean leaving behind friends and favorite activities. Balancing these lifestyle changes with your emotional well-being is vital to enjoy the journey toward financial independence.

It’s a One-Size-Fits-All Plan

Unlike what some might think, the FIRE (Financial Independence, Retire Early) movement is not a one-size-fits-all plan. Each person’s situation, goals, and lifestyle are unique. What works for one individual may not work for you. It’s imperative to consider your personal circumstances, including income, expenses, and long-term goals. Designing your FIRE path allows you to tailor it to fit your life, making it more achievable and satisfying.

Personalize Your Approach

Personalize your approach to the FIRE movement to ensure it fits your aspirations. Start by assessing your financial situation and identifying your goals. Whether you want to retire early or simply gain more flexibility in your work life, adapting the principles of FIRE to your needs is vital. This way, you create a sustainable plan that you can realistically follow.

Different Goals for Everyone

Approach the FIRE movement with the understanding that everyone has different goals. What excites you might differ from others’ aspirations. Some people aim to retire in their 30s, while others may want to achieve partial financial independence and keep working in a fulfilling job. You can define success for yourself based on what truly matters to you, whether it’s traveling, spending more time with family, or pursuing hobbies. Tailoring your FIRE journey will help you stay motivated and focused on your own distinct goals.

Real Estate Is a Must

Once again, there’s a common myth that you must invest in real estate to achieve financial independence. While real estate can offer great returns, it’s not the only path to financial freedom. In fact, many people successfully reach their FIRE goals through other investment types. For more insights, check out this article on 10 Myths About Early Retirement.

Other Investments Viable

Estate planning is just one part of the bigger picture. You can also consider stocks, bonds, or mutual funds. Each of these investment types has its own advantages and can contribute to your FIRE journey. It’s all about finding what works best for you.

Diversify Your Portfolio

If you want to build wealth, diversifying your portfolio is key. This means spreading your investments across different asset classes. By doing this, you reduce risk and improve the chance of steady growth.

Real estate is great, but don’t limit yourself. A mix of stocks, bonds, and even peer-to-peer lending can help balance your portfolio. When one investment performs poorly, others can thrive, keeping your financial goals on track. Consider seeking advice from a financial expert as you build your diversified investment strategy.

You Need Complex Strategies

Not everyone needs a complicated plan to achieve financial independence. Many believe you must have advanced financial knowledge or complex strategies to succeed in the FIRE movement. However, this isn’t true. You can start your journey by following straightforward approaches. To learn more, check out Breaking down myths about the FIRE movement.

Simplicity Can Work

An effective FIRE plan doesn’t have to be complicated. Often, the simplest strategies are the most powerful. By focusing on saving a portion of your income and investing it wisely, you set yourself on a clear path to financial independence.

Basic Principles Are Enough

Enough with the myths surrounding the need for complex financial tactics. Many people achieve FIRE by sticking to fundamental principles, like budgeting, saving, and investing wisely. Understanding and applying these basics can lead you to your financial goals without the need for intricate strategies.

Principles such as tracking your expenses, living below your means, and regularly investing in low-cost index funds are effective methods. You don’t need to be a finance expert; basic knowledge paired with discipline can take you far. Focus on what works for you, and stay consistent with these foundational steps to reach your financial independence.

It’s Impossible to Achieve

Keep in mind that many people think the FIRE Movement is just a dream. They believe it’s out of reach for most. However, this mindset can hold you back. With the right planning and determination, you can make your financial goals a reality. Don’t let doubt stop you from exploring what’s possible.

Many Have Succeeded

Little by little, numerous individuals have turned their lives around through the FIRE Movement. Their stories show that with the right strategies, reaching financial independence is not just wishful thinking. These real-life examples can inspire you to start your journey.

Consistency is Vital

Impossible to overlook, consistency plays a significant role in the FIRE Movement. Sticking to your financial plans, saving regularly, and tracking your progress are all important for success.

For instance, setting a budget and revisiting it every month helps you stay on track. Small changes, like cutting back on eating out or finding a side gig, add up over time. With each step, you become closer to your financial goals. Consistency will build momentum, making your path to fire more attainable.

To wrap up

Summing up, understanding the reality of the FIRE movement can help you make informed financial decisions. By debunking common myths, you can better assess whether this lifestyle aligns with your goals. Whether it’s about early retirement or saving strategies, separating fact from fiction empowers you to take control of your financial future. Embrace the knowledge you’ve gained and consider how it may impact your journey toward financial independence.

10 Common Myths About the FIRE Movement: FAQ

Q: What does FIRE stand for?

A: FIRE stands for Financial Independence, Retire Early. It is a movement that encourages people to save and invest aggressively so they can retire much earlier than traditional retirement age. The goal is to achieve financial freedom and live life on your own terms.

Q: Is the FIRE Movement only for wealthy individuals?

A: No, the FIRE Movement is not just for wealthy individuals. It is accessible to anyone, regardless of income level. The key is disciplined saving and smart investing. Even those with modest incomes can join the movement by cutting expenses and prioritizing savings.

Q: Do you have to be frugal to achieve FIRE?

A: While frugality is a common part of the FIRE journey, it doesn’t mean you must live a life of deprivation. Many people find a balance by cutting unnecessary expenses while still enjoying life. It’s about spending on what truly matters to you and saving the rest.

Q: Can you still enjoy life while pursuing FIRE?

A: Absolutely! Many people who follow the FIRE Movement find creative ways to enjoy life while saving money. This could mean traveling on a budget, exploring free local activities, or finding hobbies that don’t cost much. FIRE is about finding freedom, not restriction.

Q: Is the FIRE Movement suitable for everyone?

A: The FIRE Movement may not be for everyone, as it requires dedication and a willingness to make financial sacrifices. However, anyone can benefit from its principles. The habits of saving more and spending wisely can lead to better financial health, even if full early retirement isn’t the goal.

Key Takeaways

- FIRE stands for Financial Independence, Retire Early, and is open to everyone.

- Discipline in saving and investing is key, regardless of your income.

- You can find a balance between frugality and enjoying life.

- Creativity in spending can enhance your experiences without breaking the bank.

- While not for everyone, the habits learned can improve your overall financial situation.